By Roger Pine, CFA, CFP®

You already know how valuable an annual tax return review can be – but did you know that Holistiplan’s advanced and automatically-generated tax reports offer even more benefits for your clients? From calculating total spending to finding opportunities ripe for Roth conversions, Holistiplan’s tax report has a ton of useful information you can use to take your financial planning to the next level – and you don’t have to be a tax expert to do it.

We’ve rounded up our top tax return review takeaways advisors can find easily and use to increase their value prop – while providing even better advice to clients.

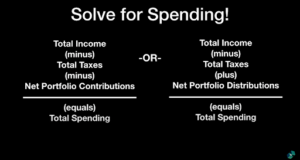

1. Solve For Spending

It may seem counter-intuitive, but often a tax return is the key to getting a real annual spending amount for a client. This is no small feat because clients often struggle to get a handle on what exactly they spend in a given year. You can give them an accurate number without digging into credit card and bank statements.

Instead of crunching through months of records, we can back solve for spending by taking the annual gross income from all sources, minus total income taxes, minus/plus and net portfolio contributions or distributions. Whatever amount is left is the amount that was consumed via spending in that calendar year. Clients will be blown away by the simplicity of this calculation and the accuracy of the final number. And you the advisor are uniquely positioned to calculate it for them because you have the tax return and you have the needed portfolio history.

2. Capital Gains/Losses Review

Reviewing capital gains or losses can be a great way to engage clients.

First, it drives home the fact that investments and taxes are two sides of the same coin. You as a comprehensive advisor have eyes on both the portfolio and the tax implications of how that portfolio is managed.

One great example of this value-add is in the case where a client’s taxable income is low enough that some or all of their long term capital gains are tax free. You can show your client how you managed to capitalize on that set of circumstances to save them real money.

Looking forward to the coming year, the carried forward capital losses will help with your end-of-year gain/loss harvesting. Now is the time to record that information so it is at your fingertips throughout the year as you make portfolio adjustments.

Going deeper still, what if your client’s short-term gains far outweigh the long-term ones? Was that a one off set of circumstances, or should something change in how your client approaches holding assets?

Related resource: Want some help making your client meetings more valuable any time of the year? Click here to download our cheat sheet, “The Financial Advisor’s Guide to Tax Planning Conversations for Every Season.”

3. Charity Tactics

A tax return review can also reveal several ways your clients could benefit from charitable giving tactics.

Would the client benefit from grouping charitable donations into alternating years through use of a donor advised fund? With only a small amount of setup, a donor advised fund used in this way can deliver thousands of dollars of additional tax deductions. A quick look at Schedule A on the tax report can determine if this strategy makes sense.

Even more powerful is the qualified charitable distribution (QCD) for clients over age 70.5. A QCD, if done correctly, represents a tax free withdrawal from an IRA. For the charitably inclined client, annual QCDs are a huge win.

4. Roth Conversions in Lower Income Years

The “Observations” section of your tax return review offers insight into when a Roth conversion may be beneficial.

Say your client, Sandy, had an unusually lower income year that put her in the 12% income tax bracket. In this instance, Sandy still had $9,000 worth of wiggle room before she would be bumped up to the next income bracket.

If Sandy expects to continue having a lower income moving forward into the next year, it highlights an opportunity to carry out a Roth conversion that fills up that 12% income bracket, without risking going into the next higher bracket. This approach is especially valuable for clients who may see higher income in future years, such as the recently-retired who no longer collect wages but do not yet collect Social Security or have Required Minimum Distributions.

The Holistiplan tax report offers a simple, at-a-glance way to see how that Roth conversion would work as you and Sandy work together toward her tax planning goals.

5. Any Surprises on Schedule B

Lastly, a Schedule B report review is a good way to ensure your clients’ assets are all accounted for correctly. There are some cases where a client may forget to disclose a part of their portfolio, or even intentionally hide it. But they aren’t allowed to hide those assets from the IRS!

Because of this, a Schedule B review is worth doing every year – you can see that Schedule B summary within your Holistiplan tax report whenever Schedule B income is reported. Check to see if there are any surprises there. A brokerage account on the side? A newly-inherited trust account? If it generated income or dividends, it will be there on Schedule B.

Many advisors feel overwhelmed by tax planning, but with the right software you can position your firm ahead of others without having to learn all of the complexities of tax law.

Want to watch Holistiplan co-founder Roger Pine walk through these 5 steps? Click here to watch the video.

Connect with Holistiplan

Take your firm to the next level with Holistiplan’s modern tax planning software. Click here to schedule your free trial today.