Holistiplan Insurance Planning

Ensure your client has the best policy in place.

Ensure your client has the best policy in place.

Much like the blind spot of estates, most clients pay little attention to their insurance. It’s another auto-renew afterthought. Until it’s too late.

Only when catastrophe comes and claims hit clients with pocket-pilfering expenses does it dawn on them that their annual policies proved insufficient or incorrect. If a flood rolls in, it may take their home and dry out their assets. As their advisor, you need to find a way to look out for them – and your AUM.

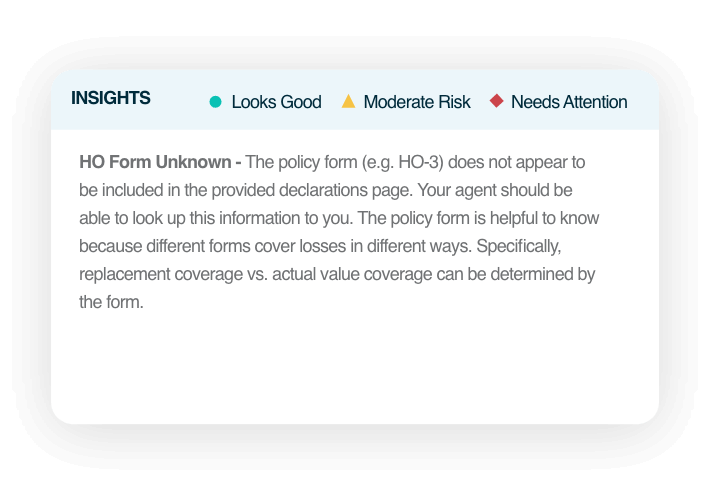

We scan your clients’ Home, Auto, and Umbrella policies to create personalized summaries, highlighting gaps in coverage, coverage considerations, and areas with adequate protection. The summaries are presented in an easy-to-understand, color-coded format, with additional notes that emphasize important industry topics for better planning.

We empower advisors to see hidden opportunities and craft personalized P&C insurance plans that address each client’s unique risk profile and coverage needs.

Identify gaps in policies and explore recommended next steps prioritized by risk level

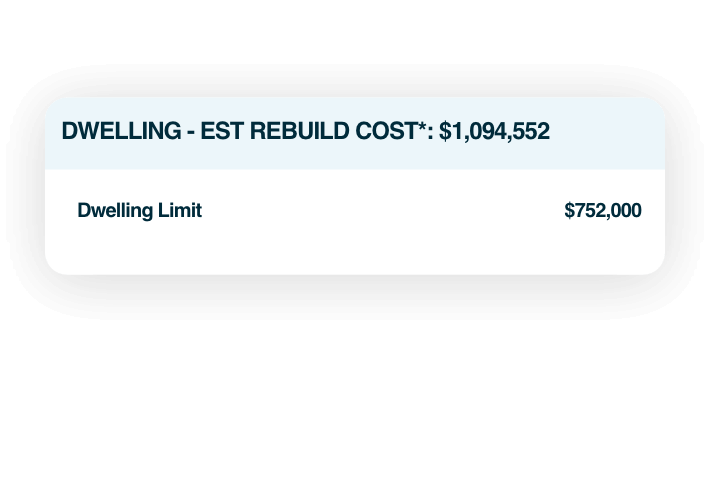

Calculate claims to adjust for appreciation, inflation, and the supply chain.

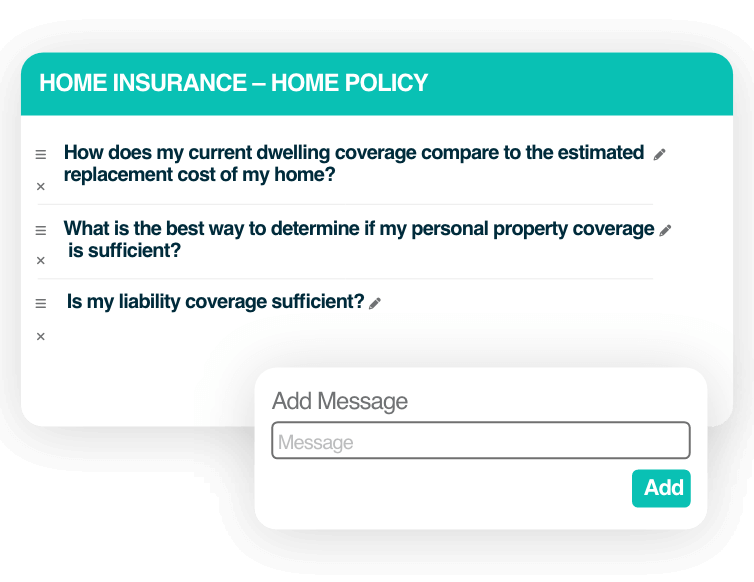

Generate a downloadable document of key questions for clients to bring to their insurance agent.

Try Holistiplan free for seven days or connect with a member of our team to catch a quick demo.