Holistiplan Tax Planning

Bring smarter, faster, and more personalized tax planning to every client.

Bring smarter, faster, and more personalized tax planning to every client.

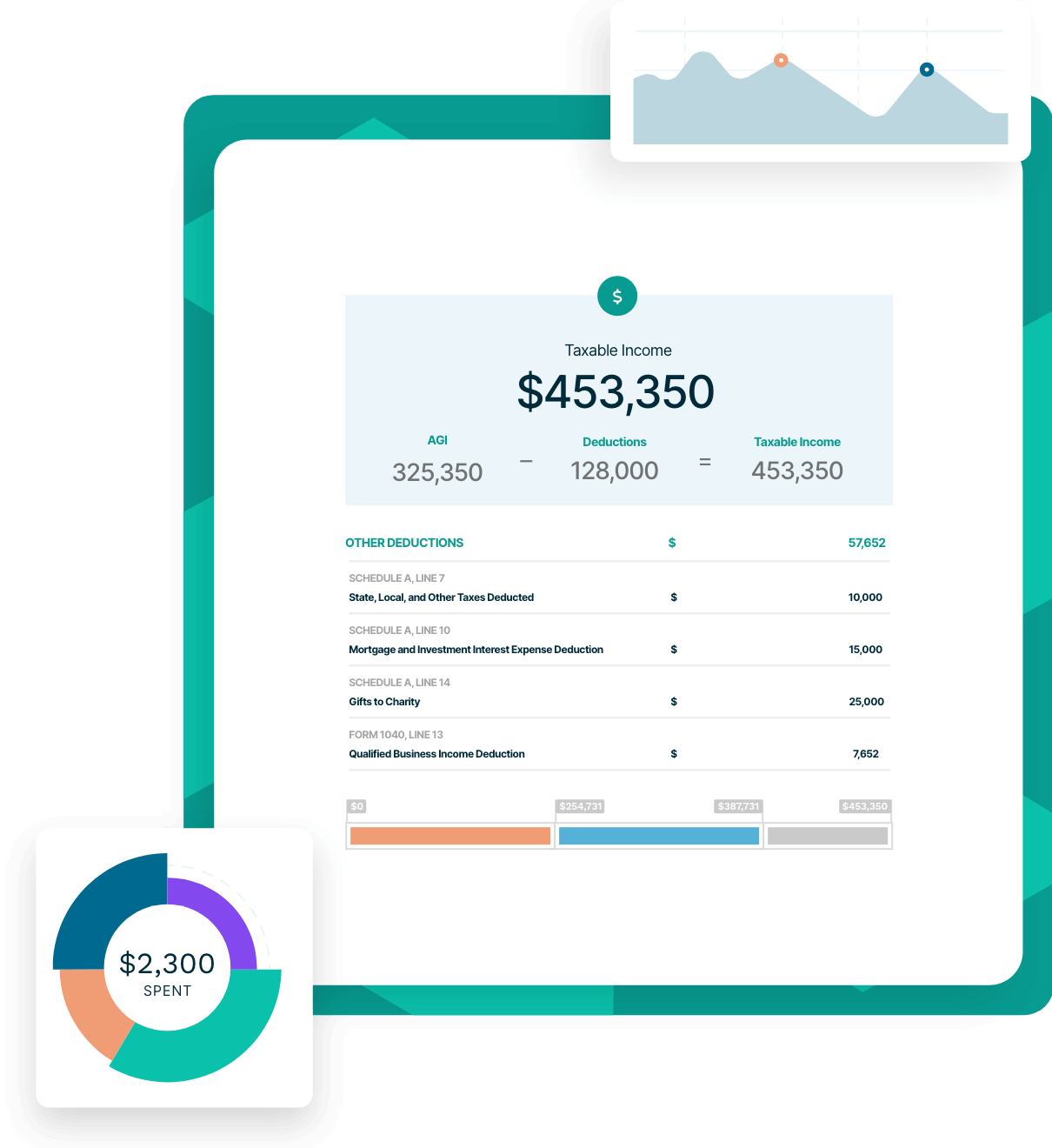

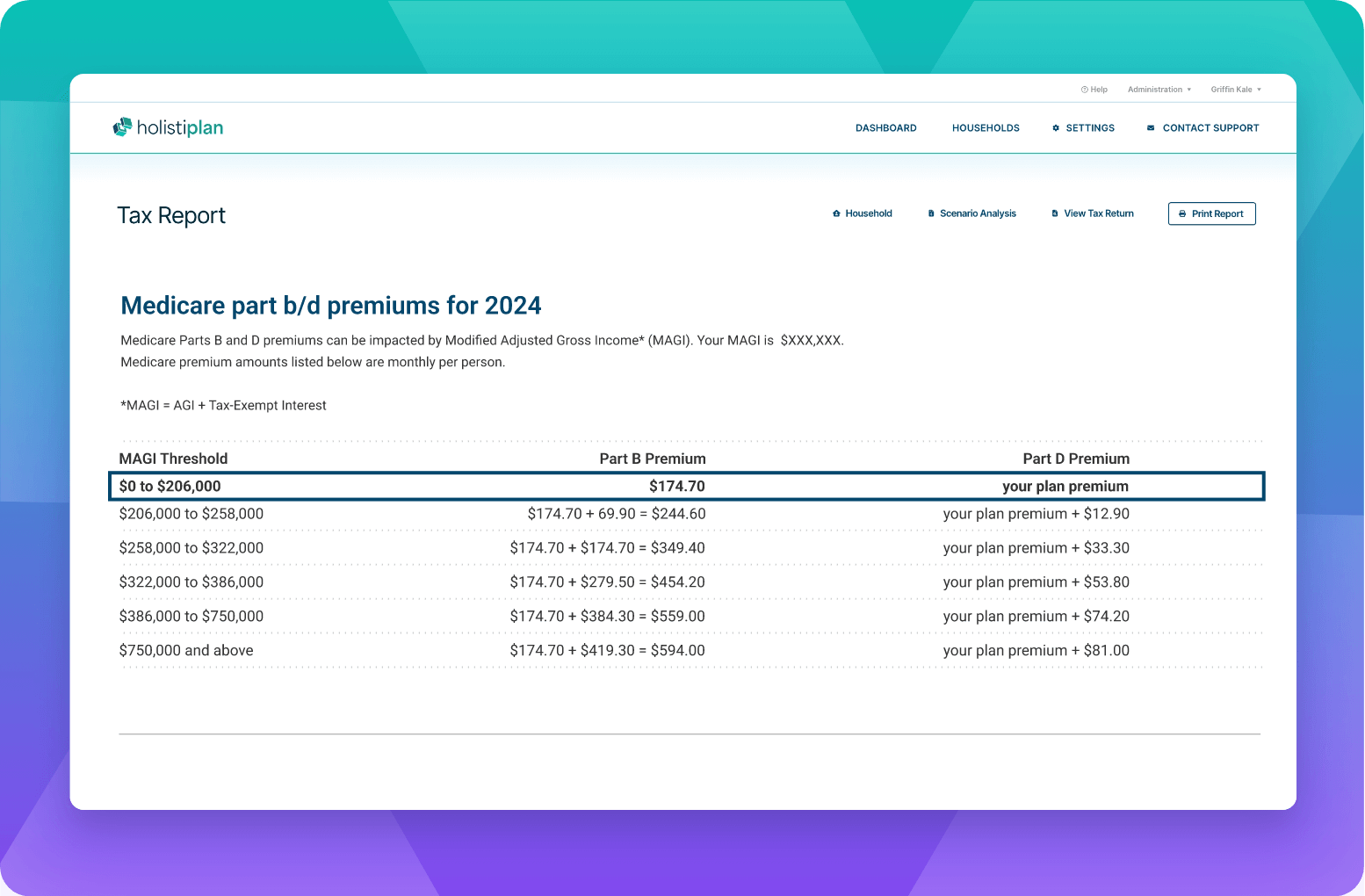

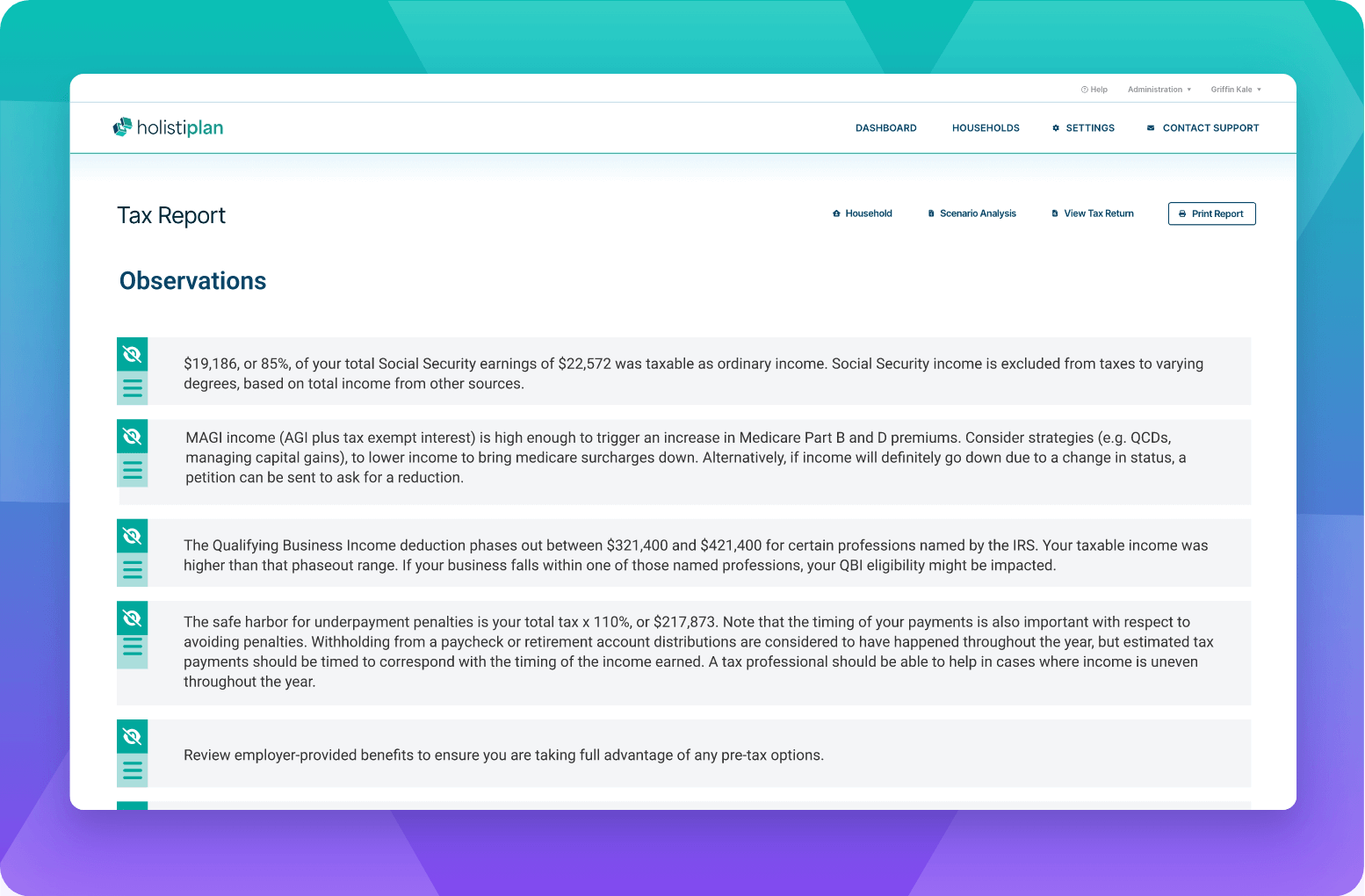

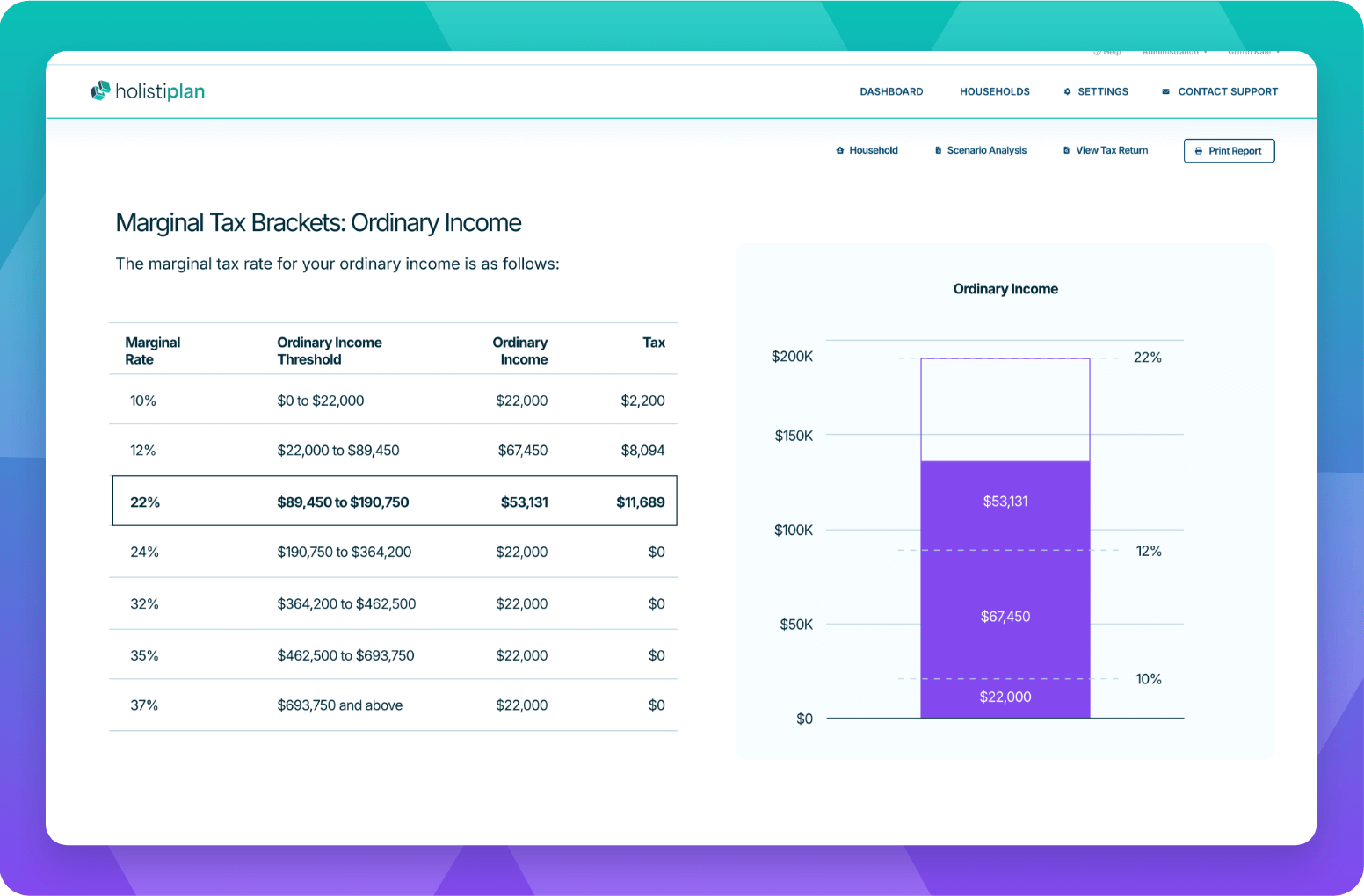

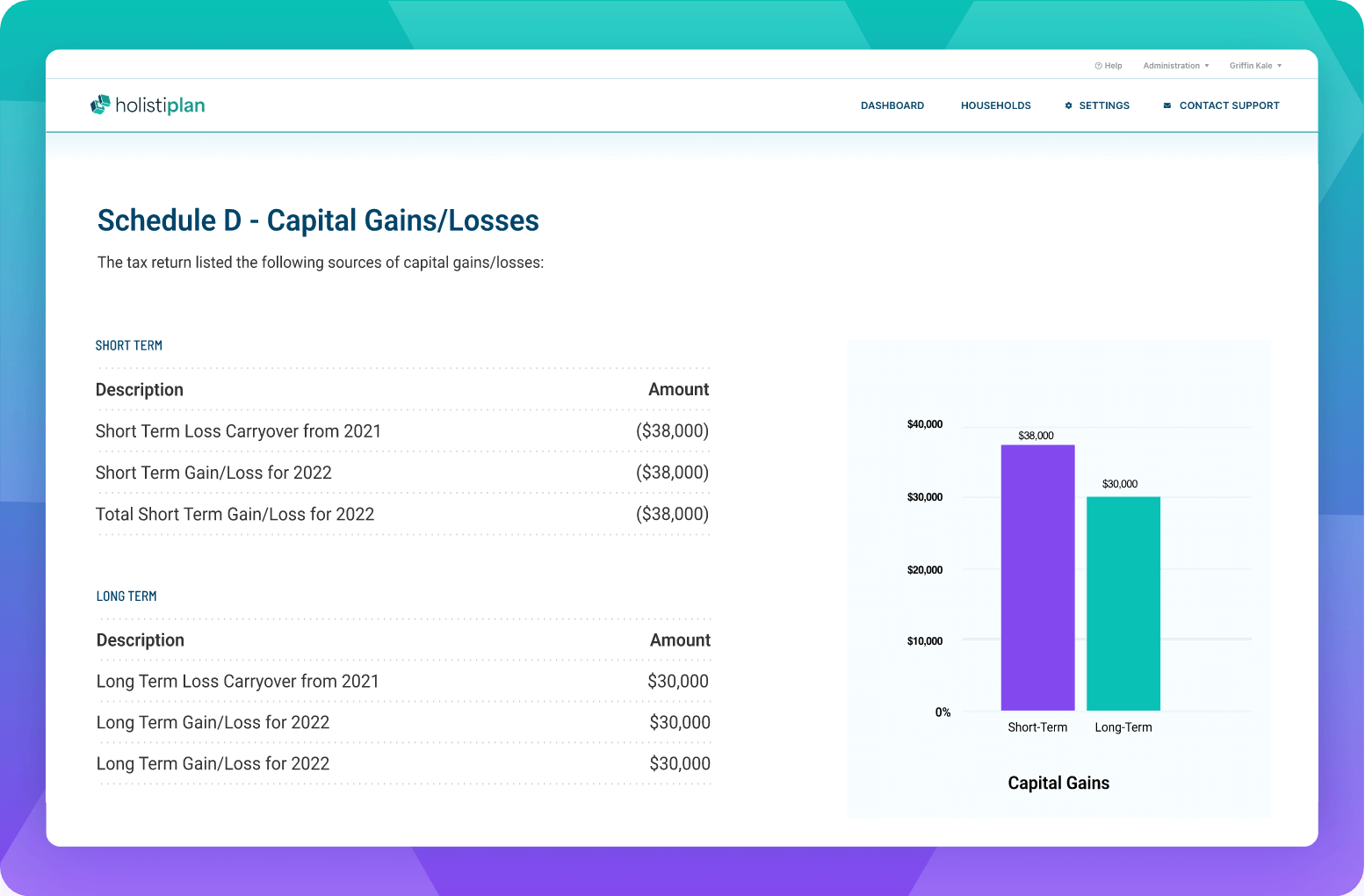

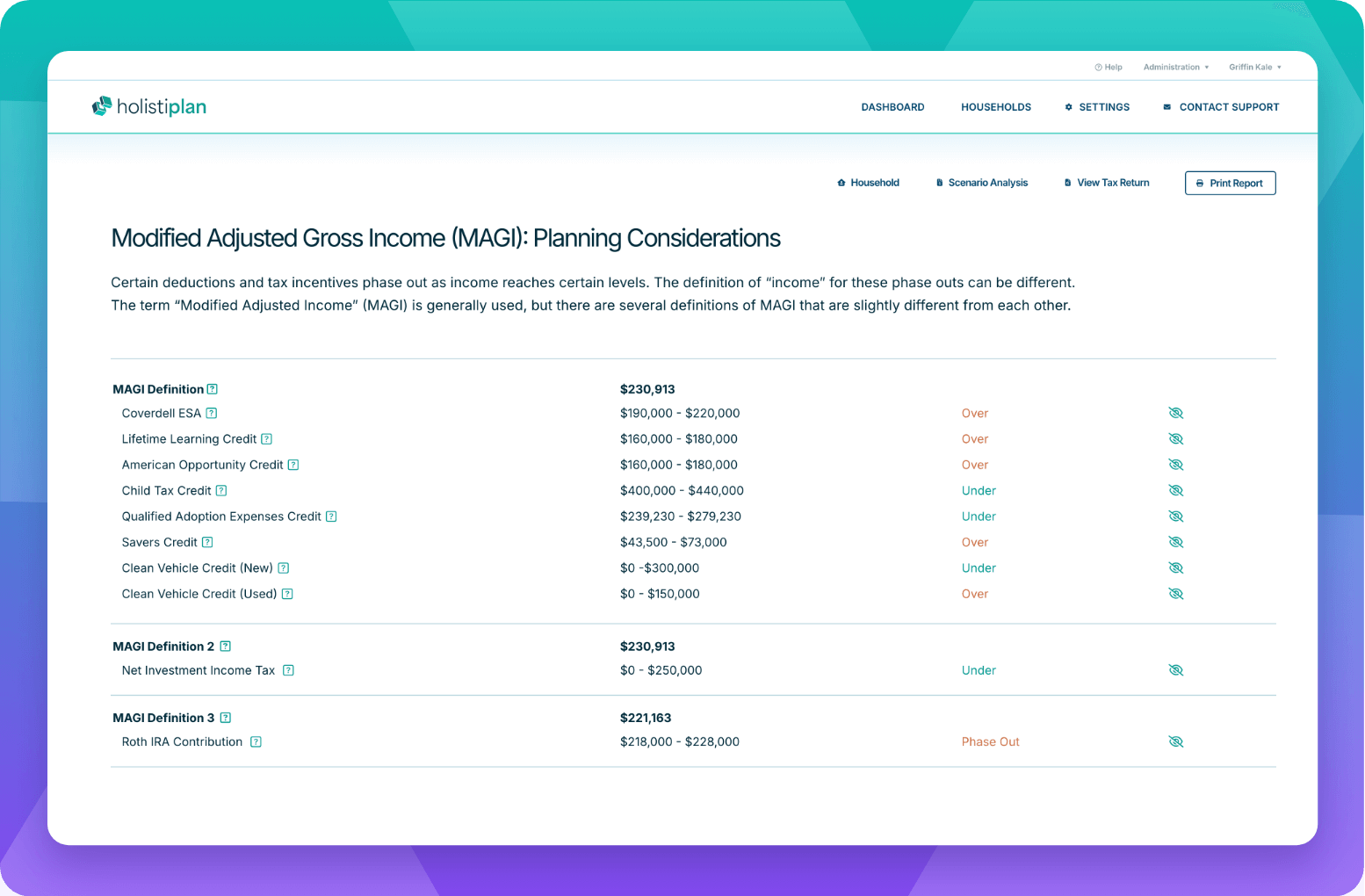

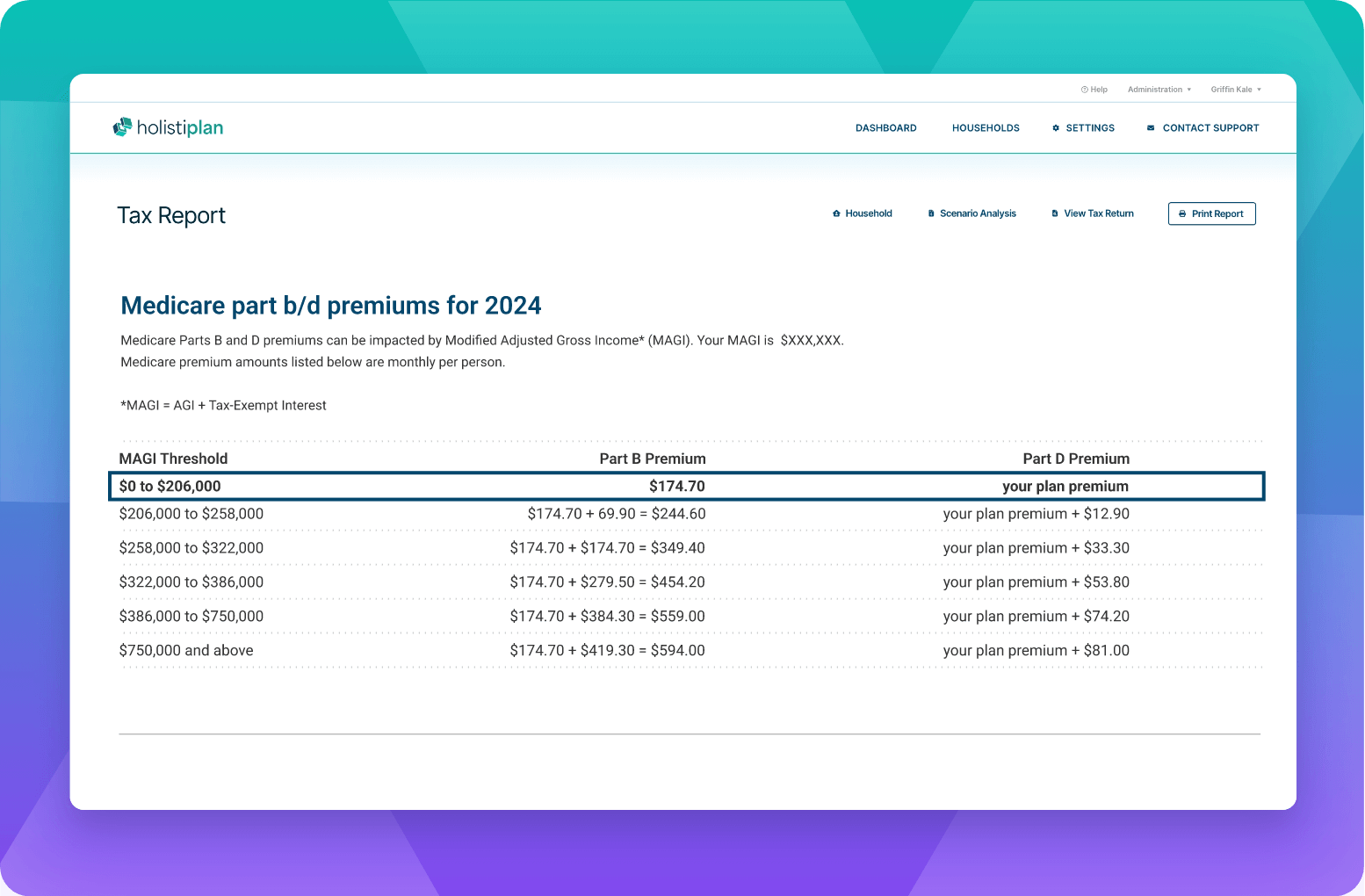

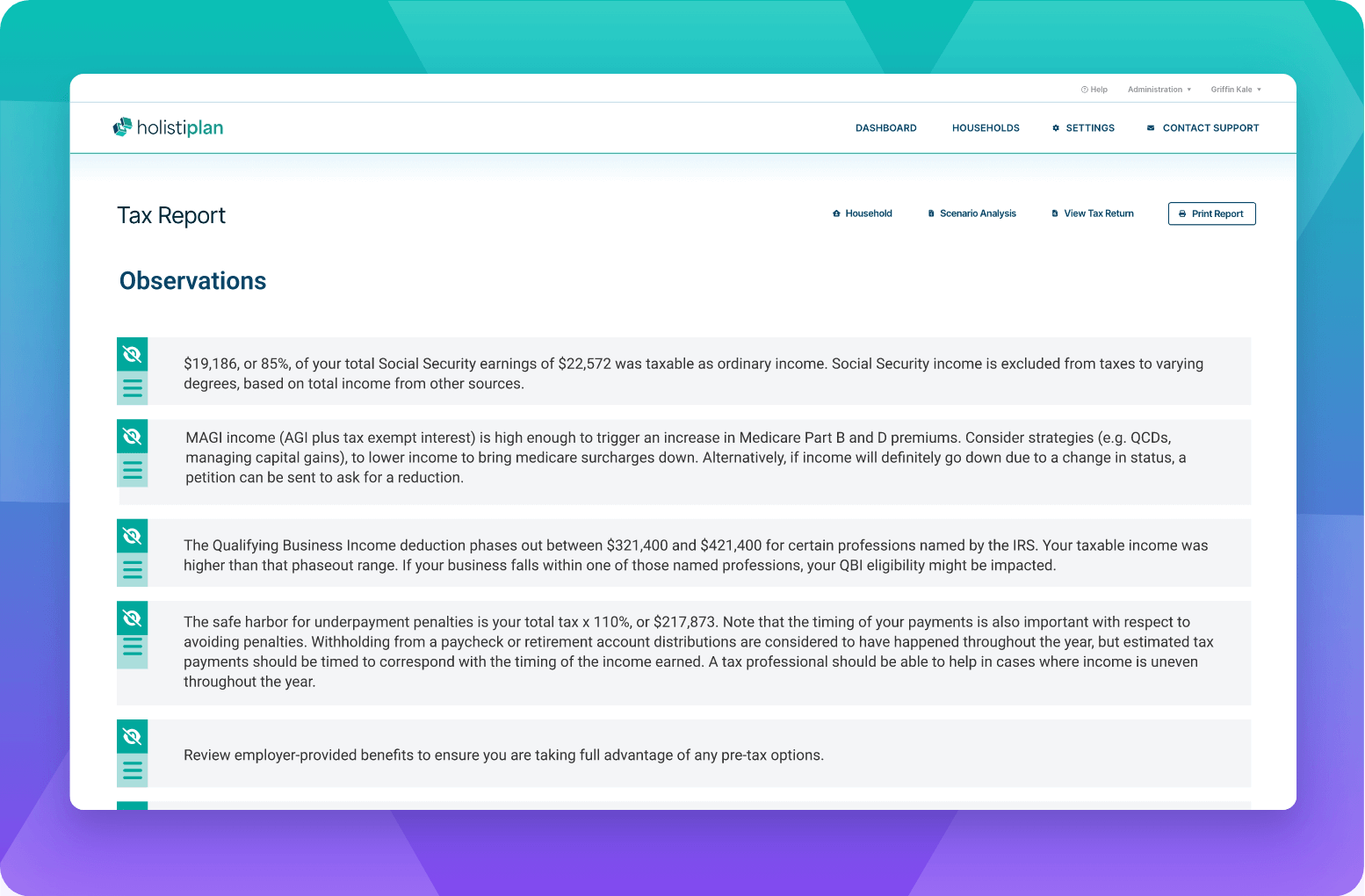

In under a minute, our OCR scans over a hundred pages – a single return now equals a tour de force multiplier dividing manual work for dividends and countless hours saved. We synthesize your clients’ numbers with dozens of distilled insights featuring:

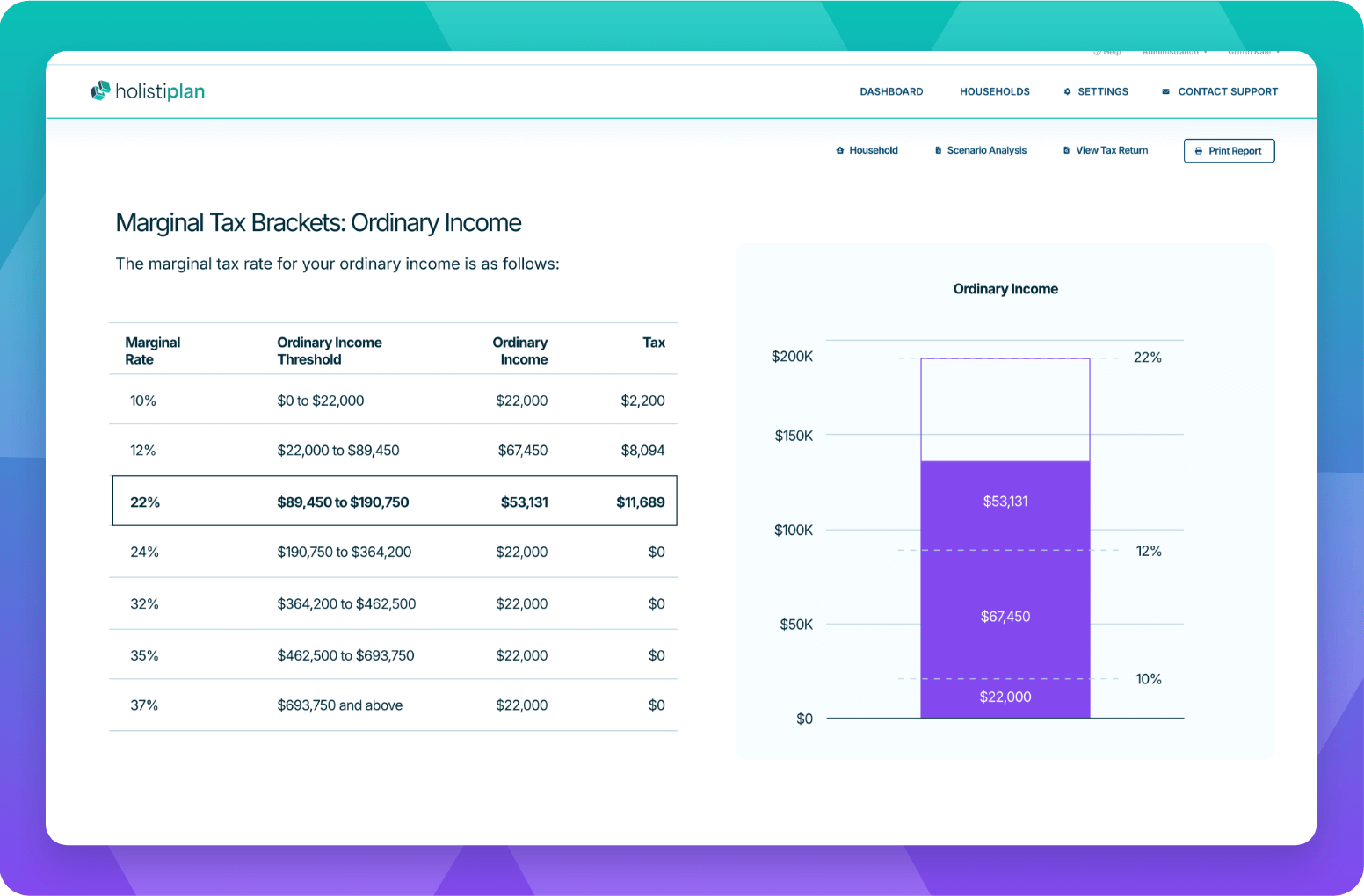

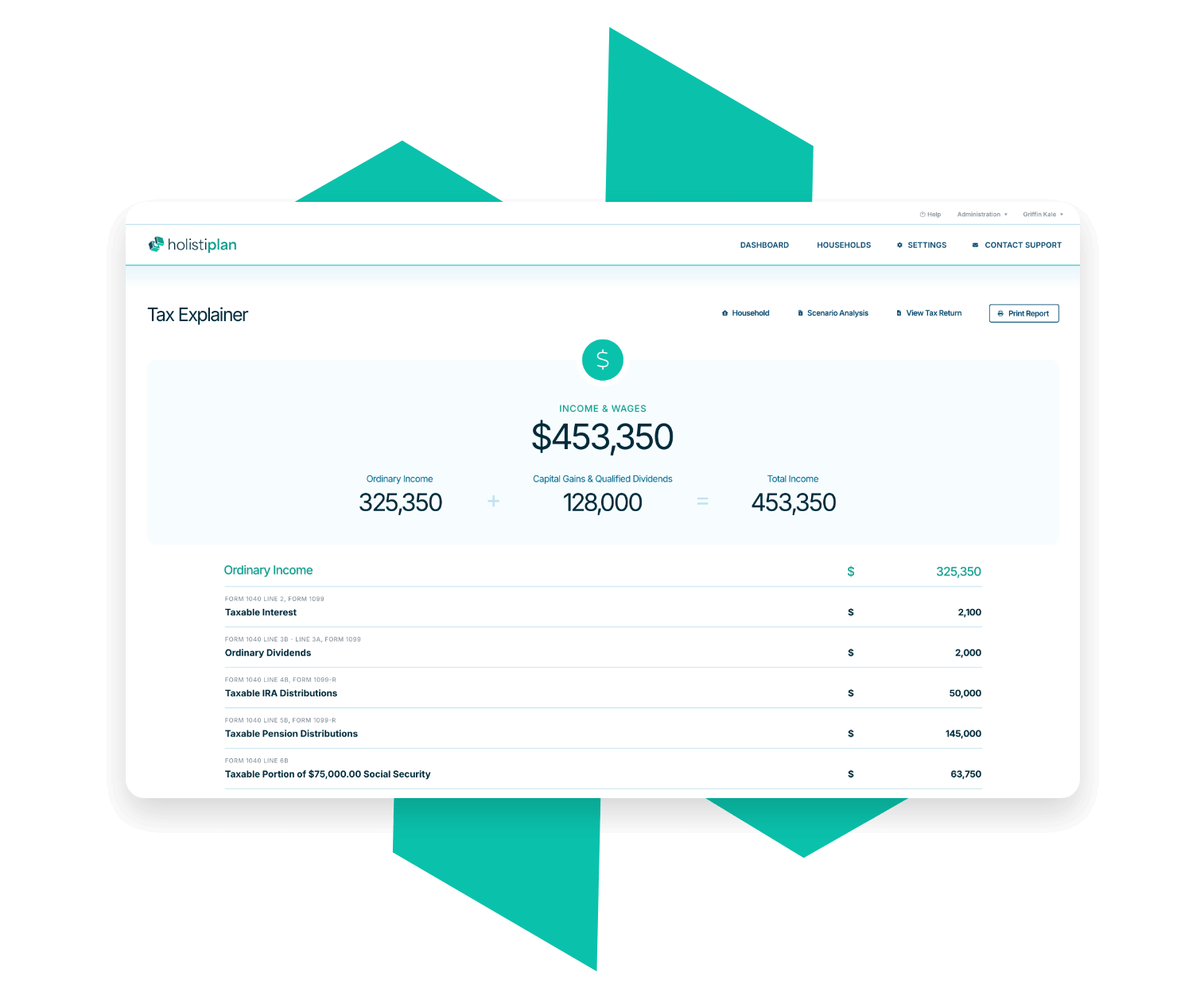

Show your client how much their income is taxed and why with our interactive tool detailing all income sources, AGI, and above-and-below the line deductions. You’ll reveal the repercussions of marginal rates, be more proficient in delineating differing percentages taxed, and tap into the origin of your clients’ refund.

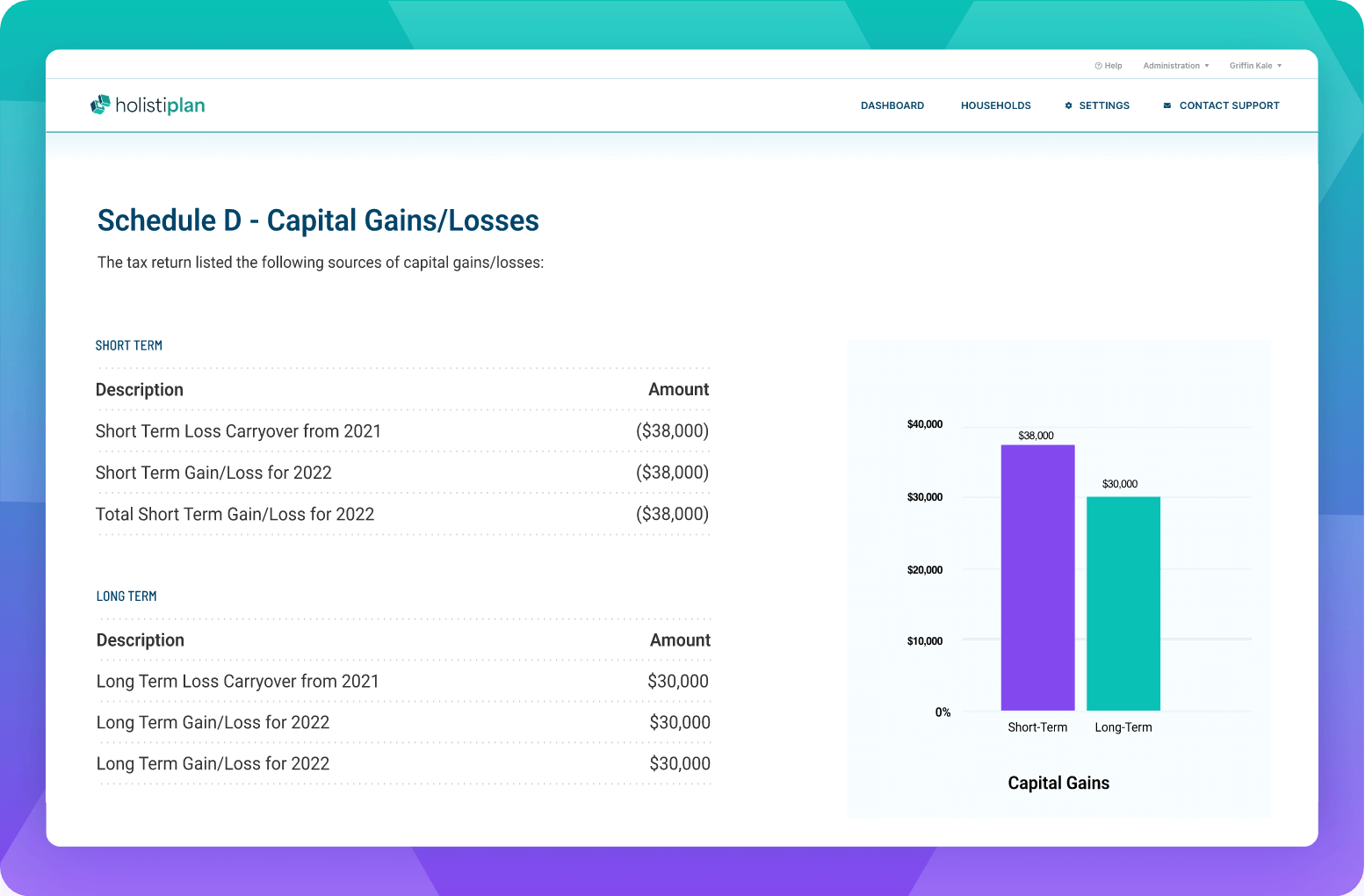

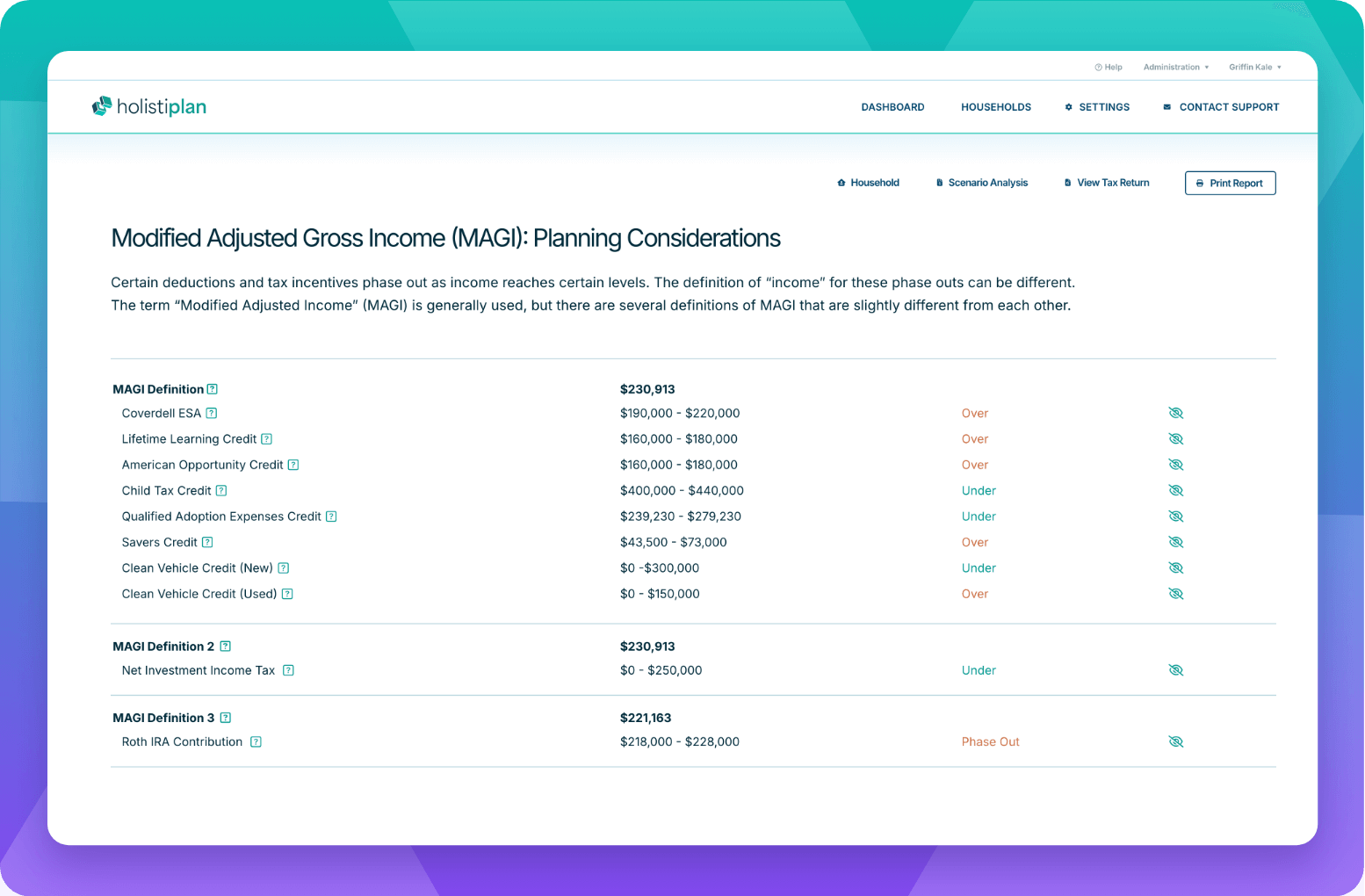

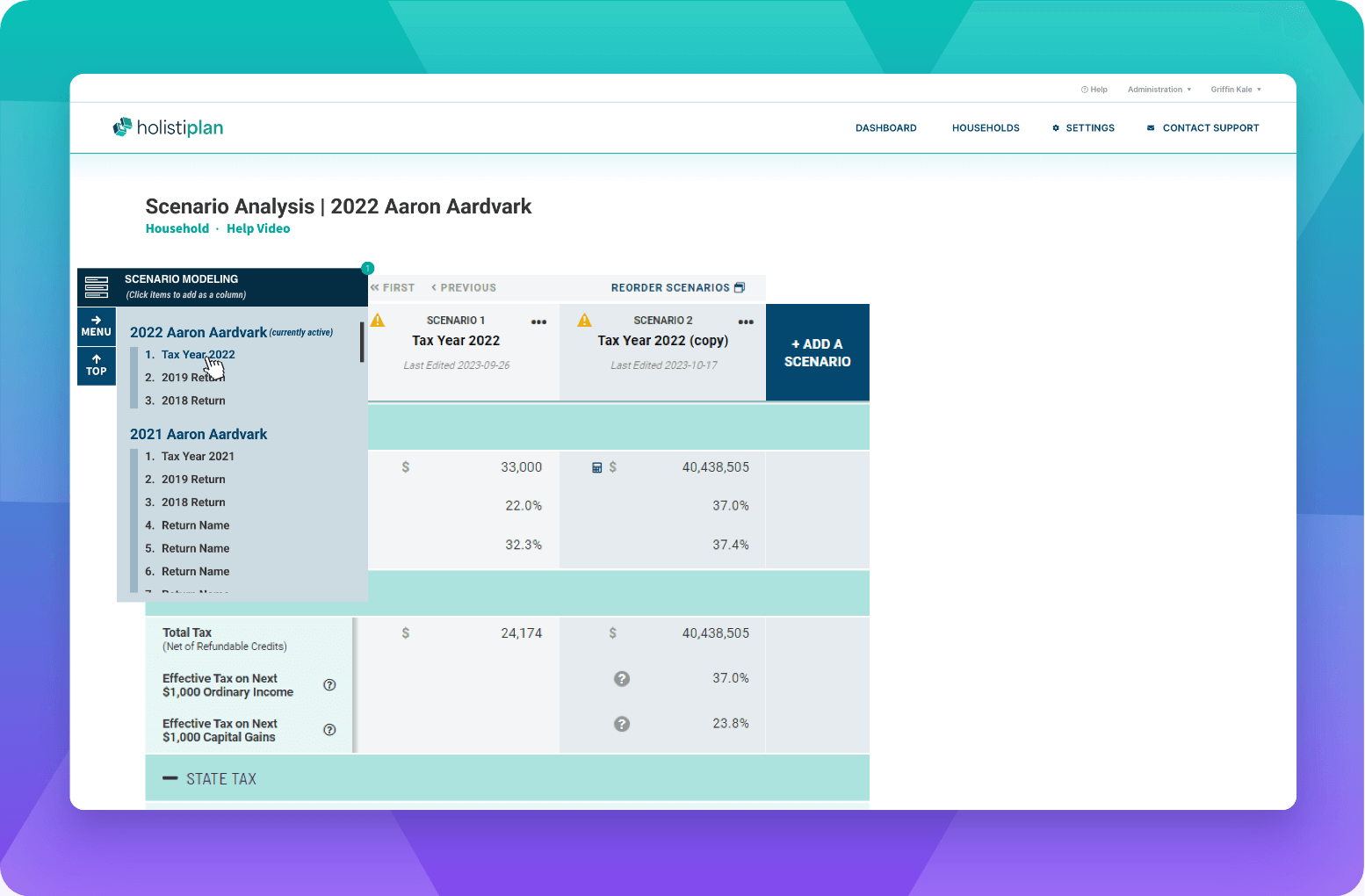

Model personalized scenarios for every stage of a client’s life before they arrive. Tweak future numbers to generate projections of possible dividends, deductions, and capital gains for your clients with strategies like Backdoor Roths and Donor Advised Funds. You’ll witness income breakpoints that your clients’ can catch early on, like tax-efficient withdrawals, charitable giving, and rollovers.

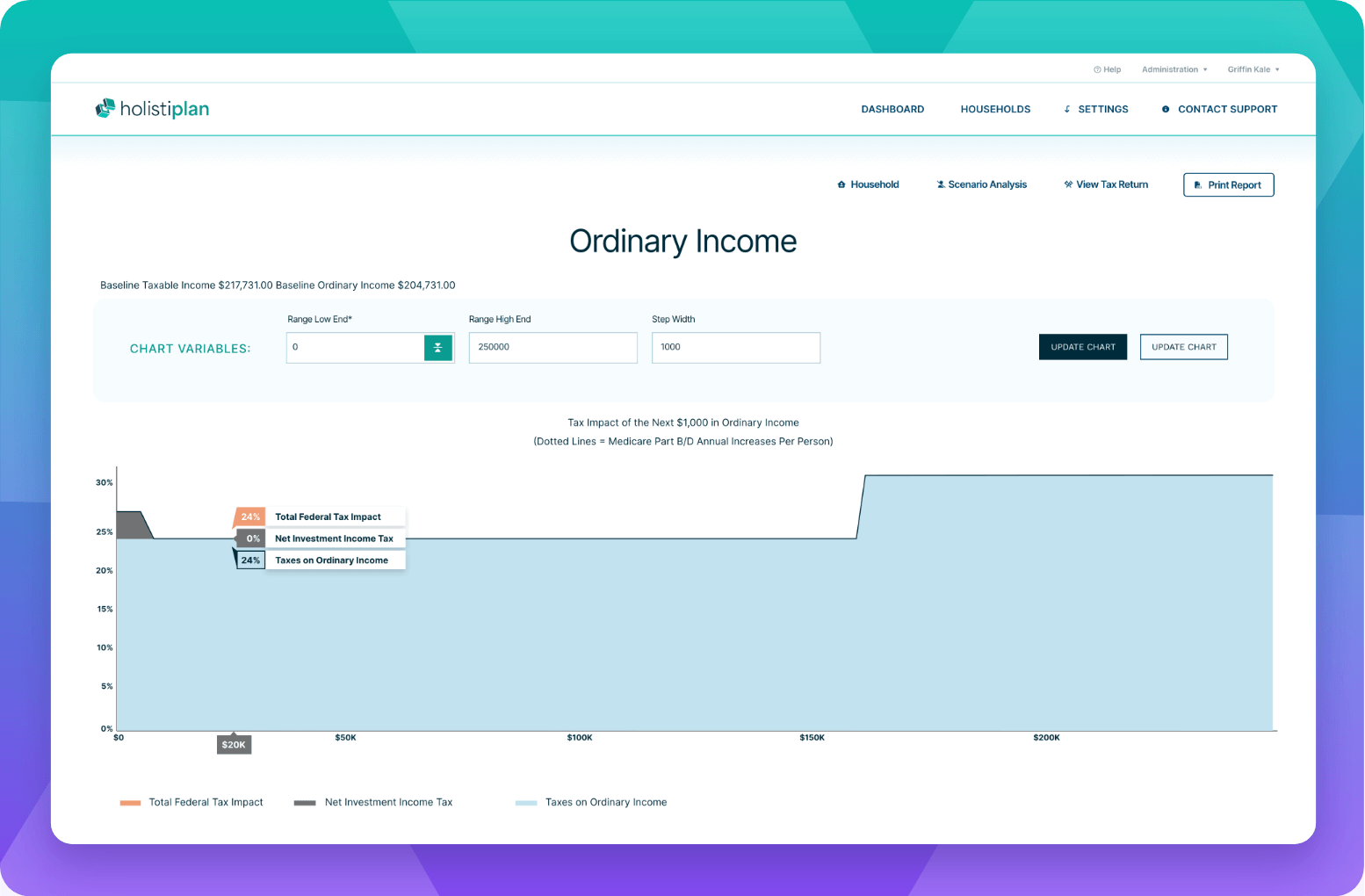

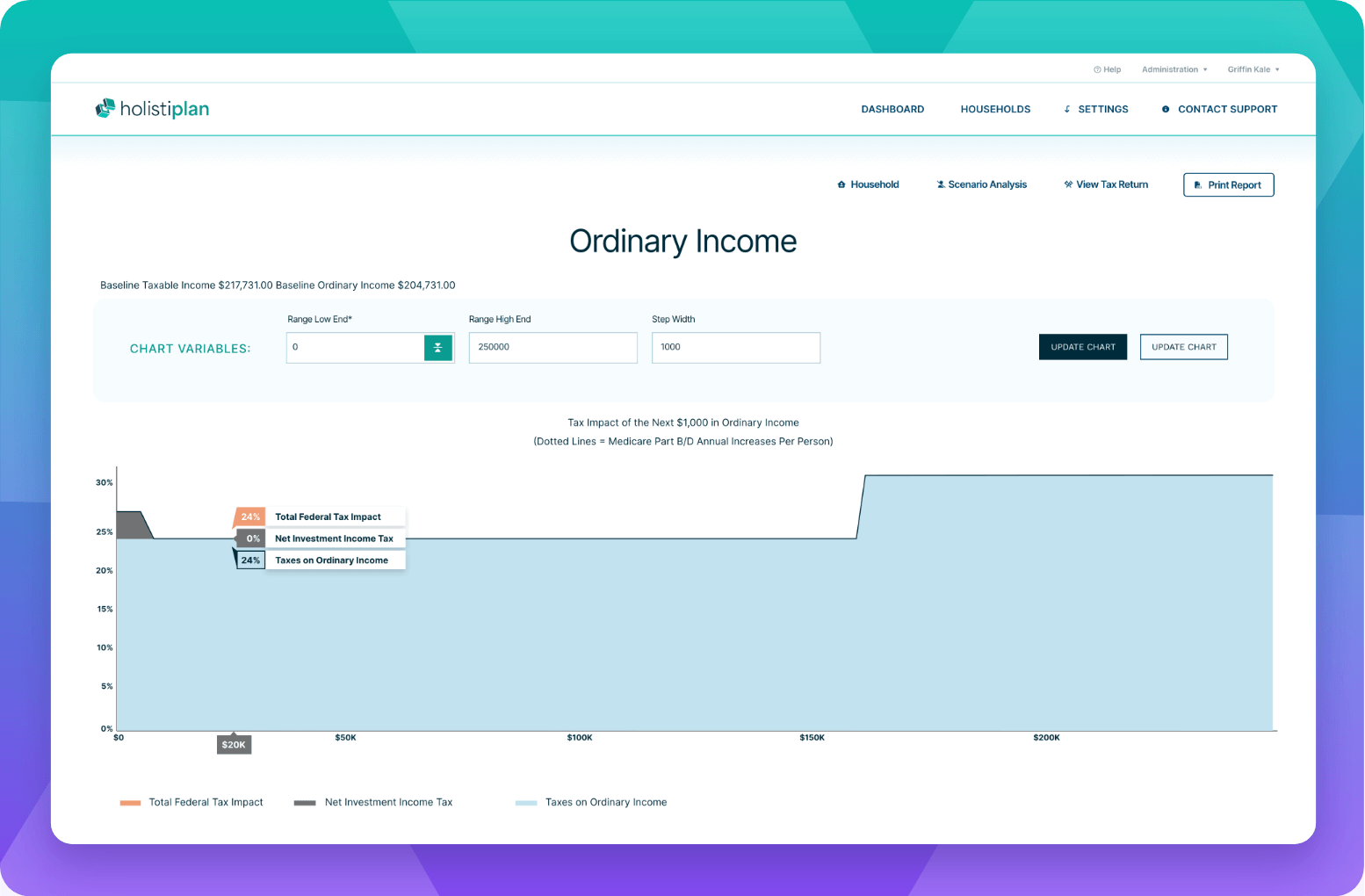

Project the impact of $1,000 increments on your clients’ income or capital gains.

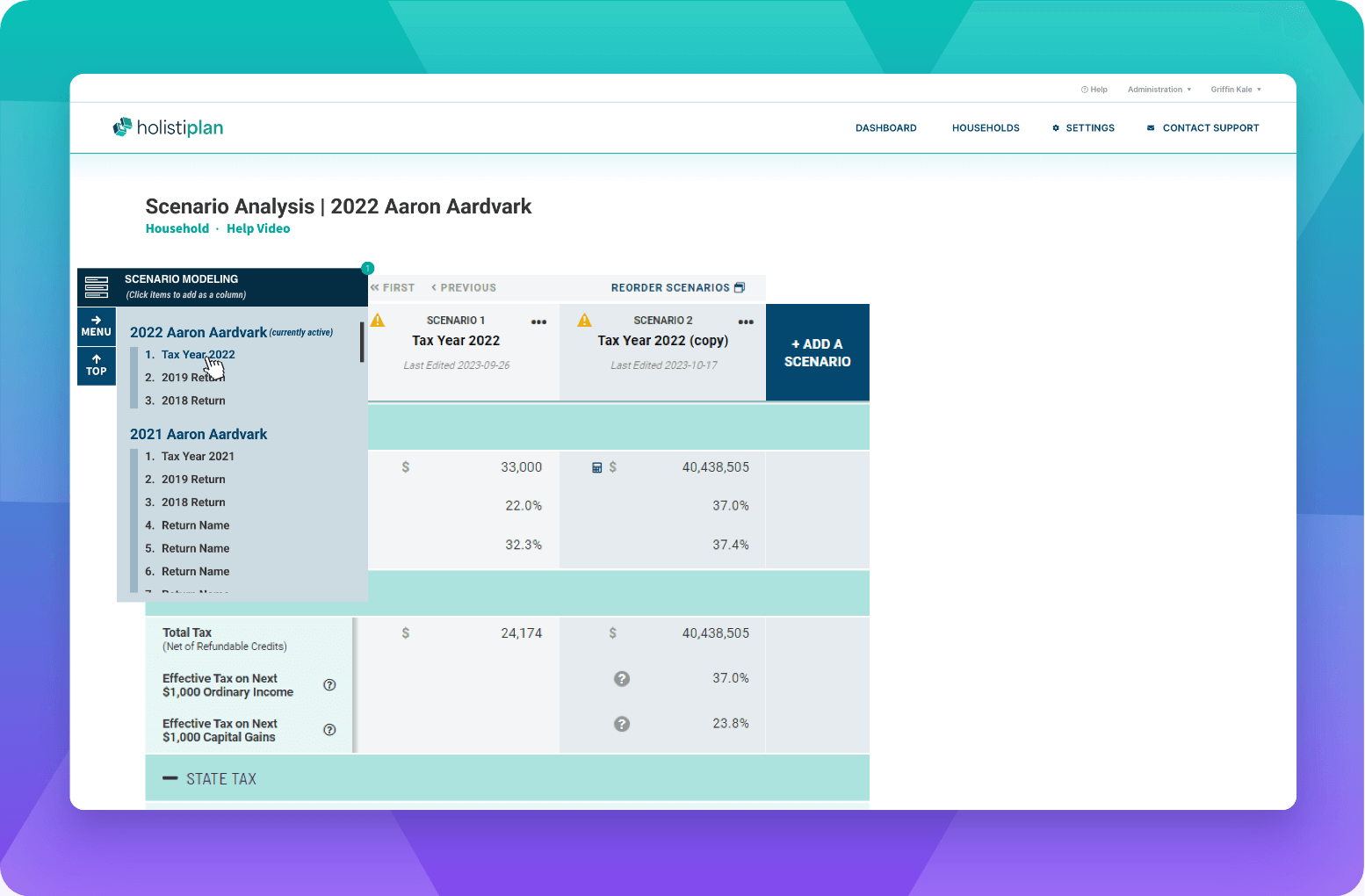

Model custom scenarios from retirement plans to equity compensation.

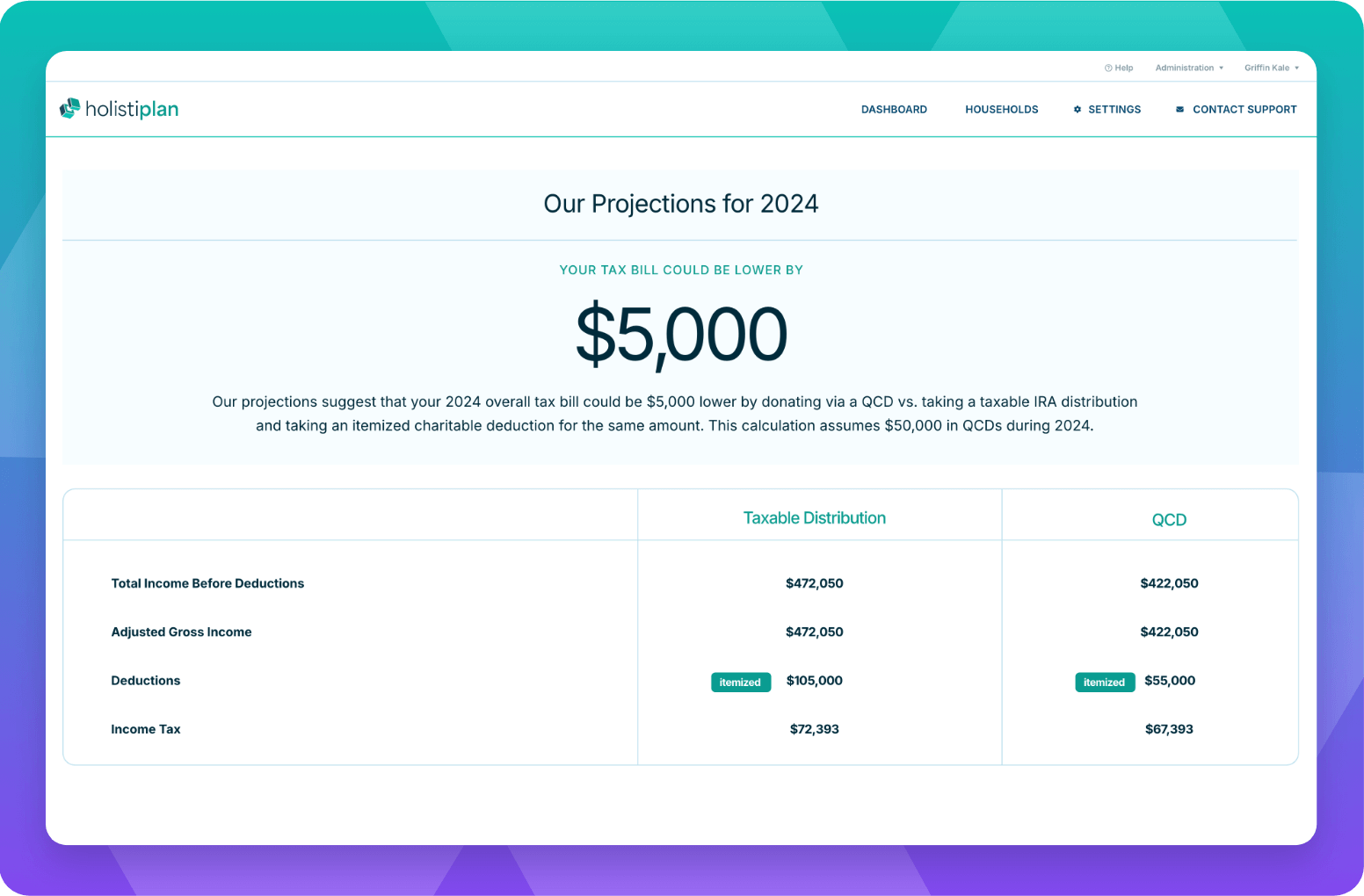

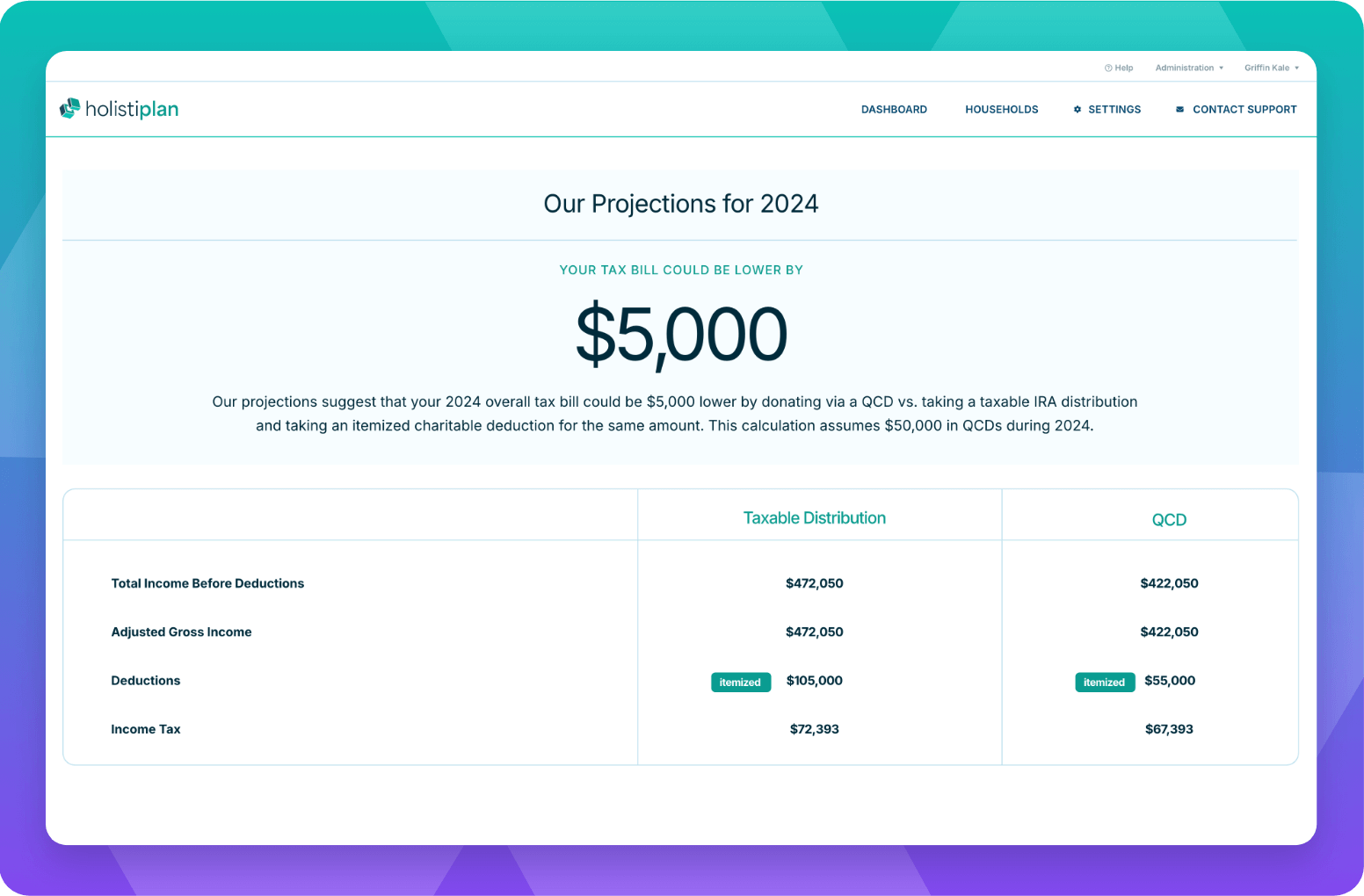

Find the age minimums and donation maximums for eligible Qualified Charitable Donations.

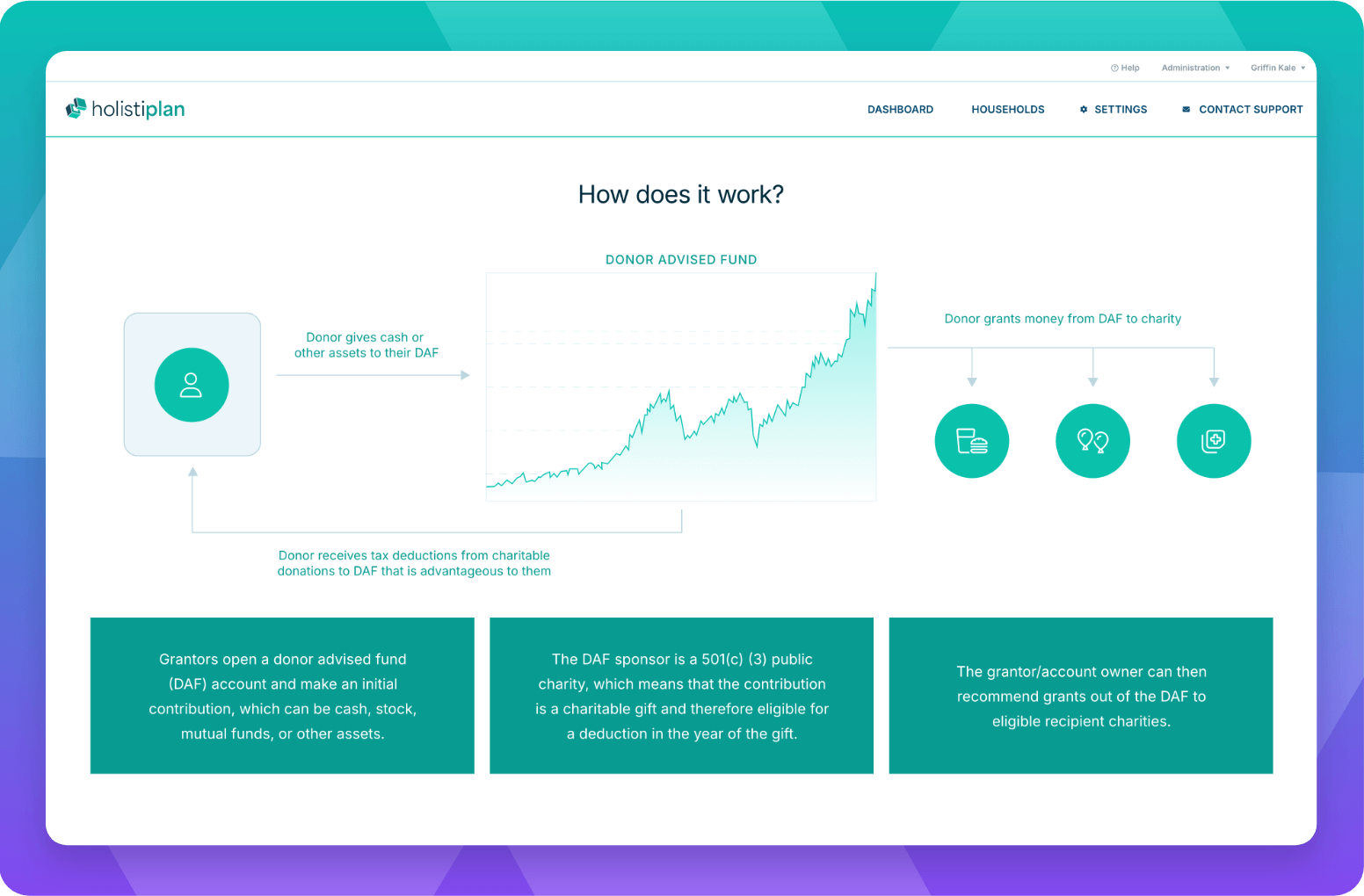

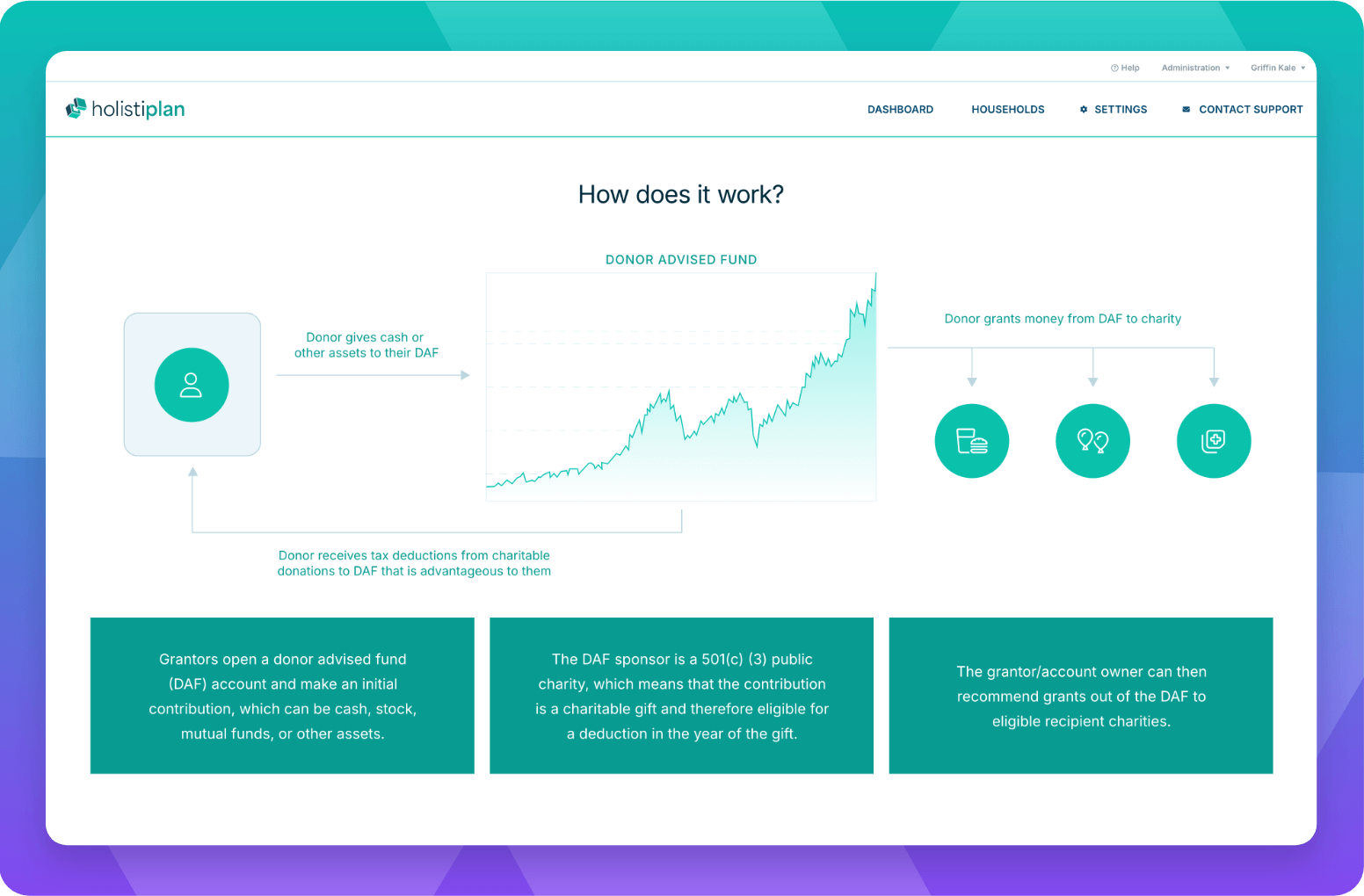

Calibrate client contributions while grasping the mechanics and potential of a Donor Advised Fund.

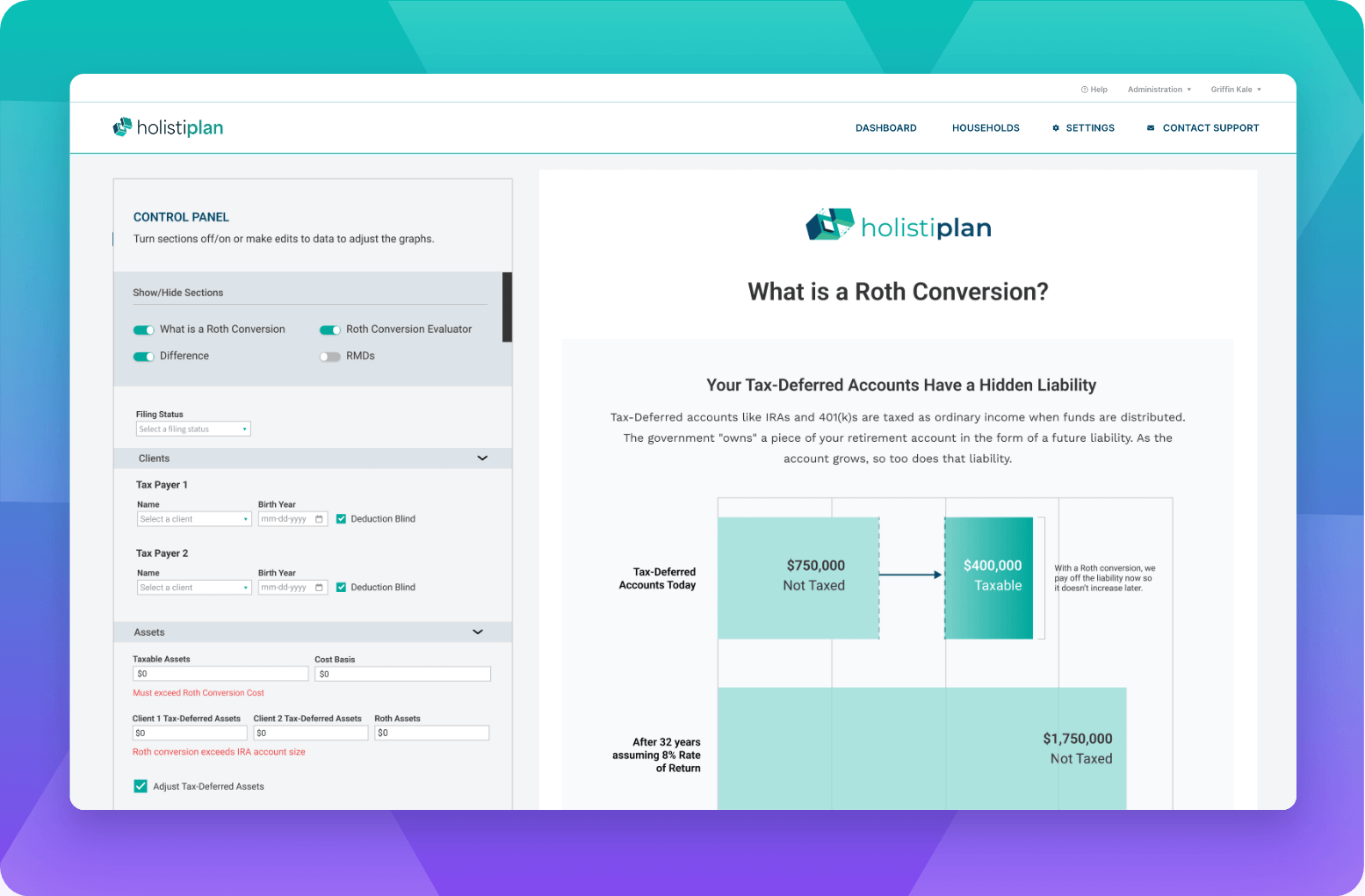

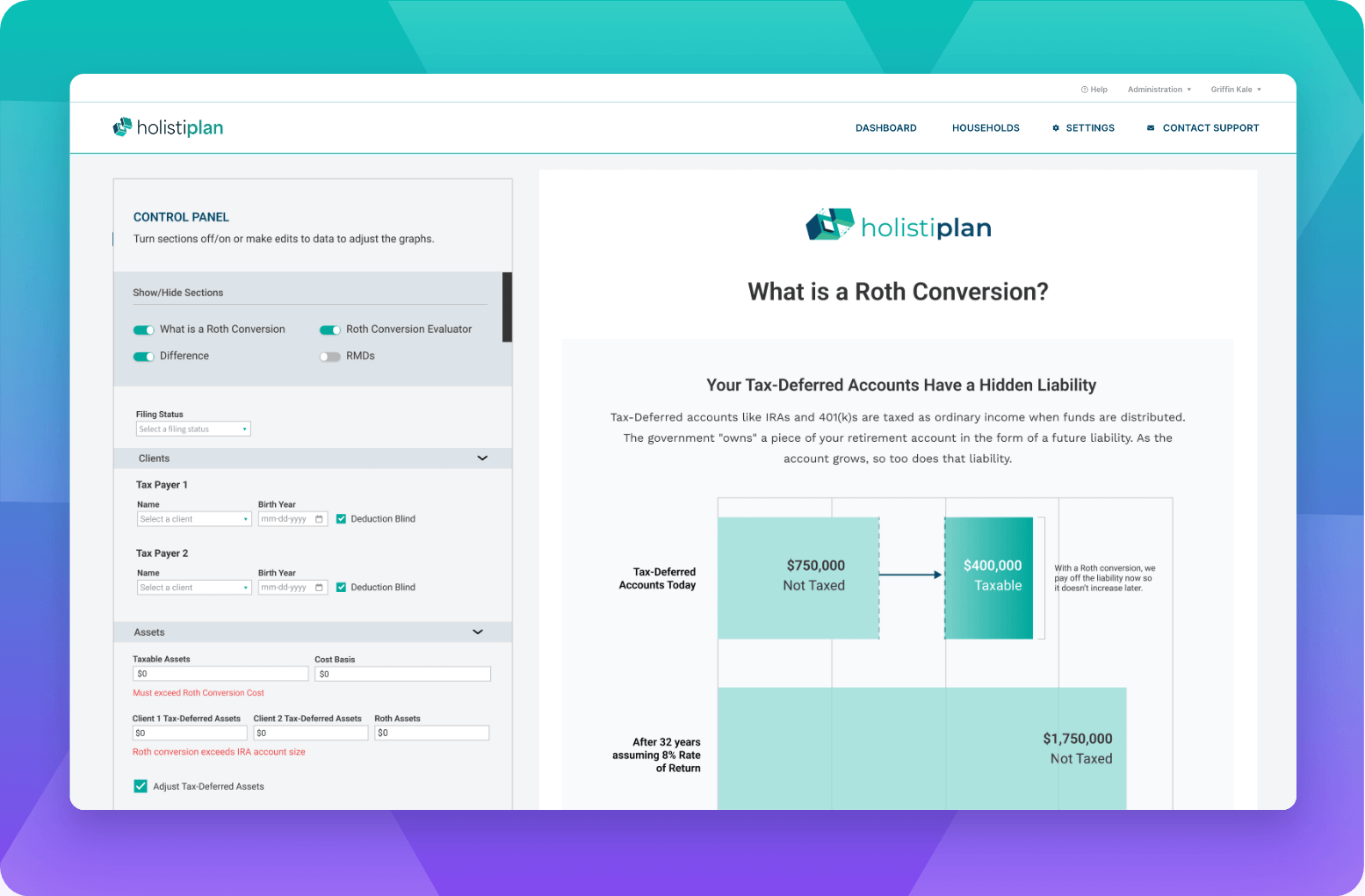

From tax-deferred accounts to rate of return, welcome to all the context and content you need regarding ROTH conversions.

Project the impact of $1,000 increments on your clients’ income or capital gains.

Model custom scenarios from retirement plans to equity compensation.

Find the age minimums and donation maximums for eligible Qualified Charitable Donations.

Calibrate client contributions while grasping the mechanics and potential of a Donor Advised Fund.

From tax-deferred accounts to rate of return, welcome to all the context and content you need regarding ROTH conversions.

Try Holistiplan free for seven days or connect with a member of our team to catch a quick demo.

©2025 Holistiplan