No matter how tech savvy we become, one thing is still clear.

Across every industry, word of mouth still matters.

Consulting with other professionals and reading reviews from your peers is still one of the most significant ways all of us make decisions when it comes to everything from searching for event space to purchasing new software.

In the always evolving world of financial planning, estate planning software is certainly a purchase that warrants opinions and reviews from other industry leaders, particularly if you are new to it.

- Reading peer reviews is a common way that professionals across all sorts of industries choose new products for their business operations.

- Financial professionals rely on a variety of software platforms and should do their research before determining which systems are going to be best for their clients’ needs.

- When it comes to choosing estate planning software, there are several key phrases to look for when reading the reviews of your peers to ensure it’s the right software for you.

Investing in the right estate planning software can significantly enhance your practice, improve client satisfaction, and streamline your workflow.

However — with so many options on the market — it can be challenging to determine which software will best meet your needs.

That’s where peer reviews come into play.

Whether you’re new to estate planning or looking to upgrade your current system, let’s look at some of the important insights from other financial advisors that can help guide you in choosing the most comprehensive estate planning tools for your practice.

Peer Review Checklist: Key Words to Look for in Estate Planning Software Reviews

When you’re in the market for any type of new software, it’s common to turn to the experiences, insights, and opinions of your peers.

Their reviews can provide a wealth of information and help you make an informed decision, especially if you are looking for software you are unfamiliar with or trying to upgrade to the most sophisticated or comprehensive system.

Here are some key phrases that you will want to look for when you’re researching estate planning software:

#1: It has an intuitive interface.”

An intuitive interface is essential for estate planning software, as this is a key factor that will directly impact everyone’s experience when using it.

When software is intuitive, it means users can easily find the tools and features they need without extensive training or frustration.

This is particularly important in estate planning, where complex financial and legal documents are involved as well as multiple individuals, such as estate planning attorneys, financial planners, clients, and often their family members.

An intuitive interface often includes clear navigation menus, step-by-step guides, and helpful prompts to ensure effective estate management that is easy for everyone to understand.

Here are some other phrases to look for when it comes to the software’s intuitiveness:

- Ease of Use: Software that requires minimal effort to learn and use, allowing financial planners to focus on their core tasks rather than troubleshooting the software.

- Clear Navigation: Simple and logical organization of features and tools, reducing the time spent searching for specific functions.

- Visual Aids: Graphical representations and visual cues that guide users through the estate planning process, making it easier to understand and complete.

2. “It has comprehensive document management.”

Solid document management is a critical feature in estate planning software.

It ensures that all necessary documents, such as wills, trusts, powers of attorney, and other estate planning documents are easily accessible and well-organized.

Financial planners rely on strong software that offers customizable templates, secure storage, and efficient document sharing options.

How estate planning documents are organized, managed, and updated over time are all key components you want to look for when choosing the best software for you.

Look also for these key phrases when reviewing a software’s documentation management system:

- Customizable Templates: Pre-designed templates that can be tailored to meet specific client needs, ensuring consistency and accuracy.

- Secure Storage: Protection of sensitive documents with encryption and other security measures, ensuring client confidentiality.

- Version Control: Tracking changes and updates to documents, allowing planners to maintain accurate and up-to-date estate plans.

Elevate Your Practice with Holistiplan

Holistiplan is trusted by thousands of advisors to deliver faster, more valuable financial plans. Start your free 7-day trial and see the difference for yourself

Get Started Today3. “The software offers seamless integration with the rest of our systems.”

When you’re introducing a new software platform to your financial planning process, you will want it to be compatible with your existing tools and systems.

Seamless integration ensures that data is easy to implement and enhances your firm’s overall financial offerings and efficiency. It should allow you to maintain a cohesive workflow without much disruption.

Whether it’s your investment management platforms, your client relationship management (CRM) system, or your firm-wide document management tools, good integration can bring everything together into a unified, efficient workflow.

This interconnectedness reduces the need for manual data entry, minimizes errors, and ensures that all aspects of your financial planning process are synchronized.

Here are some other phrases to look for when it comes to a system’s ability to integrate well:

- Compatibility: Ability to connect with other software and platforms, ensuring a cohesive workflow.

- Data Syncing: Automatic updating and syncing of data across different tools, minimizing errors and inconsistencies.

- API Capabilities: Provision of APIs (Application Programming Interfaces) that allow for custom integrations and enhanced functionality.

4. “It has strong security features.”

Security is paramount in all aspects of financial planning, since the sharing of sensitive and confidential client information is a huge part of the overall process.

Financial planners need assurance that the software they use employs advanced security measures to protect data.

This includes encryption, multi-factor authentication, and regular security audits. Additionally, compliance with industry standards is crucial to ensure that the software meets legal and regulatory requirements.

Keep an eye out for some of the following phrases when researching an estate planning software’s security strengths:

- Encryption: Protection of data both in transit and at rest, ensuring that it cannot be accessed by unauthorized parties.

- Multi-Factor Authentication: Additional layers of security that require multiple forms of verification before granting access.

- Compliance: Adherence to legal and regulatory standards, ensuring that the software meets industry requirements for data protection.

5. “The customer support is excellent.”

Responsive customer support is a vital component of any estate planning software.

Even with an intuitive interface, it’s not uncommon to encounter challenges or have questions, particularly when you’re first being introduced to the system.

High-quality customer support should include things like prompt responses and a highly skilled and friendly support staff. It should also provide multiple channels for communication, such as live chat, phone, and email.

Comprehensive training resources, such as webinars, tutorials, and user guides, also play a significant role in helping users maximize the software’s potential.

Here are some other key phrases for ensuring a software system has the type of customer support you need for your estate planning needs:

- Prompt Response: Quick and effective resolution of issues, minimizing downtime and disruption.

- Knowledgeable Staff: Support teams with a deep understanding of the software and estate planning processes.

- Training Resources: Availability of educational materials that help users fully utilize the software’s features and capabilities.

6. “The system is cost-effective.”

Cost-effectiveness is often going to be a crucial consideration when selecting estate planning software.

Operating a financial planning firm has a variety of expenses, and staying within your given budget is a key factor for being able to operate efficiently and effectively.

Transparent pricing structures, with no hidden fees or unexpected costs, are highly valued when it comes to new software.

Financial planners look for software that offers good value for money, providing extensive capabilities and support at a reasonable price.

Look for reviews that also use these phrases when it comes to initial and overall costs:

- Transparent Pricing: Clear and straightforward pricing information, allowing planners to make informed decisions.

- Value for Money: Evaluation of the software’s features and benefits relative to its cost, ensuring a good return on investment.

- Flexible Plans: Availability of different pricing options, such as monthly or annual subscriptions, to suit varying needs and budgets.

7. “The estate reports are easy to understand.”

Estate planning involves intricate details and complex documentation, and you’ll need a software system that provides both you and your clients clear and easy-to-understand estate reports.

Look for reviews that mention the software’s ability to generate concise and comprehensive reports, simplifying complex information into user-friendly summaries.

The reports should also be accessible to all stakeholders involved. Whether it’s the law firms that created the original documents, or family members who may be involved in the planning, it’s important to make sure that everyone can look at the reports and understand the desired goals and plan.

Here are some other key phrases to look for when estate reporting is being reviewed:

- Clear Summaries: Indicates that the software produces straightforward and easily digestible summaries of a client’s overall estate plan.

- User-Friendly Reports: Makes it clear that all the reports generated for the estate plan are designed with the user in mind.

- Accessible to Stakeholders: Clarifies that anyone who is involved in the process can have easy access to the information that you have generated from the estate plan.

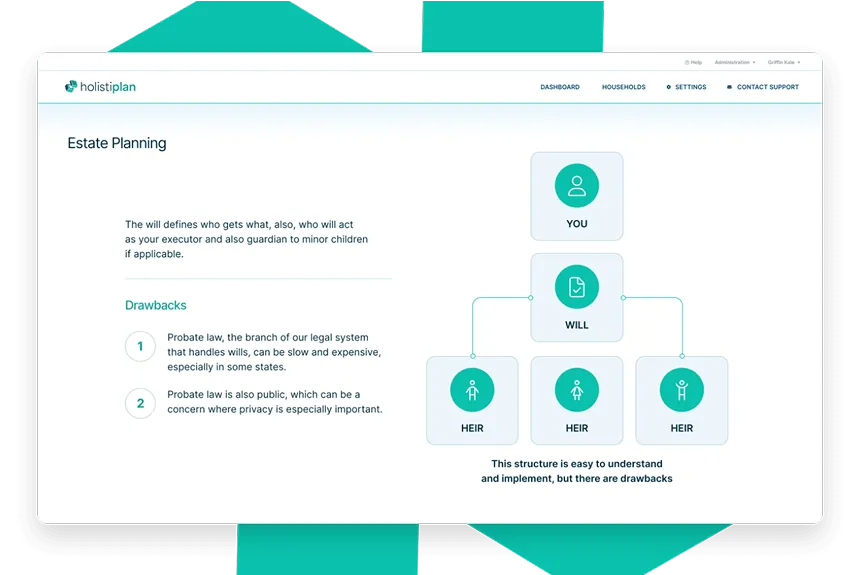

8. “The asset diagrams are comprehensive and all-inclusive.”

Clients want to see how all their assets are accounted for in their estate plan.

Comprehensive and all-inclusive asset diagrams will help everyone involved be able to visualize the entire estate, making it easier to understand the distribution of assets. These visual tools can enhance communication and ensure that every aspect of the estate is considered during the planning process.

Look for these key phrases pertaining to asset diagrams as well:

- Detailed Diagrams: Indications that the software provides thorough and precise visual representations of assets.

- Inclusive Visuals: References to diagrams that incorporate all necessary information, offering a complete view of the estate.

- Enhanced Communication: Mentions of diagrams that facilitate better understanding and discussions among planners, clients, and their families.

9. “There are lots of customized features.”

As a financial planner, you know that no two estate plans are alike.

Estate planning software needs to come with a wide range of customizable features in order to allow you to tailor the platform to each person or family’s specific needs and requirements.

For example, while calculating estate taxes for one client may be a high priority, another client may need more focus on updating their beneficiaries or visualizing their asset distribution.

Focus on reviews that highlight the software’s ability to adjust templates, workflows, and reports according to your client needs and/or preferences.

Well-designed, customized features means that the software can handle diverse scenarios and provide personalized solutions.

These phrases are also key when customization options are being reviewed:

- Tailored Solutions: Indications that the software can be personalized to meet individual client needs.

- Adjustable Templates: References to the ability to modify templates and workflows to suit specific situations.

- Personalized Reports: Mentions of customized reports that reflect the unique aspects of each client’s estate plan.

Taking the time to read reviews on estate planning software is a wise move, particularly if you know ahead of time some of the things you’re looking for.

Spend some time exploring the key features and functionalities that your financial planning peers have highlighted in their reviews. By doing so, you can make an informed decision that aligns with your needs and enhances your estate planning services.

Efficiency Meets Value in Financial Planning

Holistiplan bridges the gap between speed and quality, helping advisors like you deliver greater value to every client

Holistiplan: The Answer to Your Estate Planning Software Needs

When it comes to selecting the ideal estate planning platform, Holistiplan stands out as an industry favorite.

In fact, with over 8,000 satisfied financial professionals using the software, it’s no surprise that our reviews are excellent and second to none!

Here are some of the things that our clients point out as the most impressive aspects of Holistiplan’s tax and estate planning software:

Intuitive Interface:

Financial professionals who are already using our software praise its easy-to-navigate design, which simplifies the estate planning process and saves valuable time. Holistiplan offers clear instructions and plenty of visual aids, making it accessible even for those who may not be tech-savvy or new to client management or complex estate plans.

Comprehensive Document Management:

Industry reviewers appreciate Holistiplan’s robust document management capabilities and ability to read and store documents accurately, something other software systems often struggle with.

Uploading, organizing, and managing client data and estate documents is straightforward and simplified with the Holistiplan platform. Secure storage and efficient sharing options make managing sensitive client information easy.

Seamless Integration:

Holistiplan excels in integrating with existing financial planning tools, such as financial planning platforms, investment management software, and CRM systems.

This interconnectedness enhances overall efficiency, reduces the need for continuous manual data entry, and ensures a cohesive workflow.

Advanced Security Measures:

Users trust Holistiplan for its stringent security protocols, including encryption, multi-factor authentication, and regular security audits.

Compliance with industry standards like SOC2 certification provides additional peace of mind.

Responsive Customer Support:

Holistiplan is known for its exceptional customer support. The support team is responsive and knowledgeable, offering quick solutions to any issues.

Comprehensive training resources, such as webinars, tutorials, and user guides, help users fully utilize the software’s features.

Cost-Effective Solution:

Financial professionals praise Holistiplan’s transparent pricing structure and flexible plans.

The software provides excellent value for money, with extensive features and benefits relative to its cost, ensuring a good return on investment.

Holistiplan’s attention to each of these factors makes it the ideal choice for estate planners seeking a reliable, accurate and efficient platform.

By choosing Holistiplan, you can enhance your estate planning services, provide exceptional value to your clients, and improve your overall productivity.

Built by CFP® Professionals,

for CFP® Professionals

Holistiplan was designed by experienced advisors Roger and Kevin to streamline your financial planning process. Achieve more for your clients in less time

Start Your Free 7-Day Trial