Streamlining Success: 4 Ways that Estate Planning Practice Management Software Will Revolutionize Your Financial Firm

Knowing what your clients need is important to your firm’s overall success.

Being able to meet those needs will build the trust needed for your clients to be satisfied and secure in your abilities as well.

As a financial advisor, you are hired for your financial expertise and ability to assist your clients in making critical money decisions.

Whether it’s planning for retirement, funding education, managing debt, or structuring estates, your job is to provide tailored financial solutions that align with each client’s unique goals and circumstances.

This is why having the right software for each of these tasks is crucial for your client’s satisfaction and your success.

- Estate planning software equips financial advisors with data-driven insights and tools to create more precise, strategic financial plans tailored to each client’s unique circumstances.

- By streamlining workflows and enhancing transparency, advisors can foster deeper trust and engagement with clients, leading to long-term partnerships and higher satisfaction.

- Scalable estate planning software enables firms to handle increasing client demands while reducing manual tasks, improving operational efficiency, and positioning the business for sustained success.

- #1: Estate Planning Software Allows for Centralized Document Management

- #2: Estate Planning Software Allows for Improved Client Communication & Engagement

- #3: Estate Planning Software is Part of a Comprehensive Tech Stack for Financial Firms

- #4: Estate Planning Software Allows for Scalability and Growth

- The Future of Financial Planning Starts With Holistiplan

From software that helps with budgeting and financial forecasting to estate planning software that allows your clients to plan well into their futures, investing in the right technology is going to ensure efficiency, accuracy, and reliability in every aspect of your financial planning practice.

Let’s look more specifically at the role good estate planning software can play for your organization and the four ways it will make a significant impact on every client’s long-term financial plans.

#1: Estate Planning Software Allows for Centralized Document Management

While it’s usually the role of estate planning attorneys to use their own estate planning legal software to draft the documents that are part of a person’s estate plan, a financial planner is tasked with the role of organizing, analyzing, and retaining these documents as part of an overall financial plan.

Some of the key legal documents estate planning law firms can create for a client’s estate plan are:

- Wills – A legal document that outlines how a person’s assets and property should be distributed upon their death. It can also specify guardianship for minor children.

- Trusts – A fiduciary arrangement that allows a third party, known as a trustee, to hold and manage assets on behalf of beneficiaries. Trusts can help avoid probate and provide more control over asset distribution.

- Powers of Attorney – A document that grants a trusted individual the authority to make financial or legal decisions on behalf of someone else in case of incapacitation.

- Healthcare Directives – Also known as advance directives, these documents outline a person’s medical preferences in case they are unable to communicate their wishes, including decisions about life support and treatment.

- Beneficiary Designations – Assigns individuals to receive assets from accounts such as life insurance policies, retirement funds, or bank accounts, bypassing probate and ensuring direct transfers.

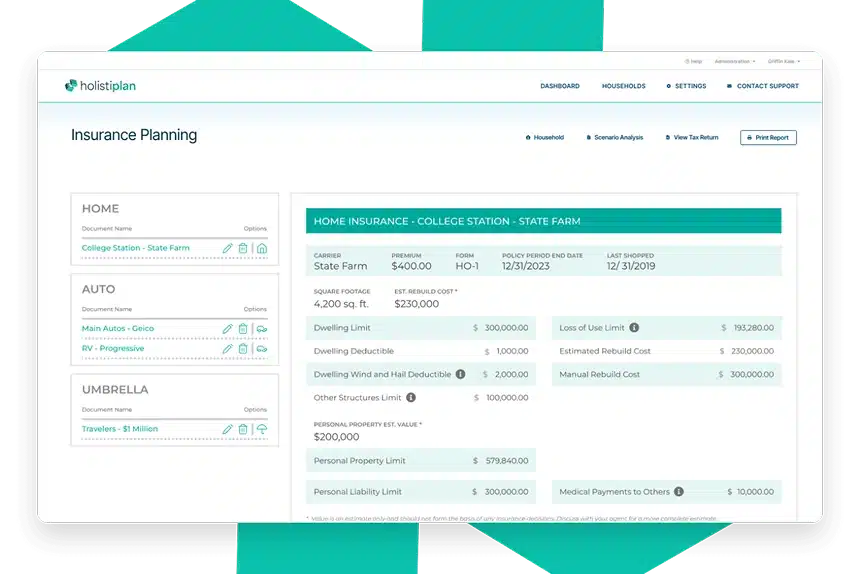

While an estate lawyer will use drafting software to create the above documents, estate planning software can help a financial planner manage these documents by providing a place to store, categorize, and retrieve each file as needed.

Efficiency Meets Value in Financial Planning

Holistiplan bridges the gap between speed and quality, helping advisors like you deliver greater value to every client

#2: Estate Planning Software Allows for Improved Client Communication & Engagement

Estate planning can be a confusing (and even emotional) process for clients.

Many estate planning clients feel overwhelmed with all the legal jargon, taxation rules, and financial strategies involved in estate planning.

Having an intuitive, client-friendly software system allows advisors to improve communication and engagement while simplifying the processes for clients.

Here are some of the biggest benefits of good estate planning software for the client:

Easy Estate Planning Documents Storage and Access

Clients no longer have to sift through piles of paperwork. With digital storage, all key estate documents are securely organized and easily accessible after the document preparation is done.

Comprehensive Asset Tracking and Mapping Tools

Provides clients with a clear visualization of their assets, helping them understand ownership structures, valuations, and the overall financial landscape.

Seamless Beneficiary Updating and Management

Life changes, and so do beneficiary designations. This software simplifies the update process, ensuring beneficiaries are always current and accurately recorded.

Strong Security Measures

Well-designed estate planning software prioritizes protecting sensitive financial and legal information. With encryption and advanced security features, clients are given the peace of mind they need, knowing their estate plan is safeguarded.

Comprehensive Snapshot of Overall Financial Health

Clients want to see how every aspect of their financial life is working together. Estate planning software can integrate estate plans with broader financial management, giving clients a holistic view of their wealth and help them make informed decisions.

With these advantages, estate planning software transforms what can be an overwhelming process into a seamless, secure, and well-organized experience for clients.

#3: Estate Planning Software is Part of a Comprehensive Tech Stack for Financial Firms

Estate planning is a crucial component of wealth management, and financial advisors often juggle multiple software systems to track investments, assets, and retirement planning.

Managing estate planning cases separately from the rest of a client’s financial portfolio can create inefficiencies, redundant data entry, and inconsistencies in client records.

Let’s look at how the best estate planning tools will easily integrate with the rest of a financial planner’s tech stack:

- It will sync with other wealth management software: Estate planning software should seamlessly integrate with portfolio management, tax planning, and financial analysis platforms, ensuring that all client data remains consistent and easily accessible across different tools.

- It will automate data sharing: Reduces manual input by pulling financial details from linked accounts, streamlining workflows, and enhancing accuracy.

- It will offer customizable reporting features: Allows planners to generate personalized reports that showcase estate planning alongside broader financial assessments.

- It will provide collaboration tools: Enables secure, real-time communication between estate planners, financial advisors, and clients, ensuring aligned decision-making.

A unified software ecosystem ensures financial firms have an all-in-one, holistic solution for estate planning, investment management, tax strategies, and client communication.

Elevate Your Practice with Holistiplan

Holistiplan is trusted by thousands of advisors to deliver faster, more valuable financial plans. Start your free 7-day trial and see the difference for yourself

Get Started Today#4: Estate Planning Software Allows for Scalability and Growth

As your firm grows and takes on more clients, manual processes can become a bottleneck. Estate planning practice management software provides scalability, allowing firms to expand operations efficiently while maintaining high-quality services.

Here are some key ways that strong estate planning software can support your firm’s growth:

- It automates repetitive tasks – Eliminates manual paperwork and data entry, allowing advisors to focus on strategy and client interactions.

- It provides analytics & performance tracking – Delivers insights into client trends, estate planning success rates, and operational performance, helping advisors refine their approach.

- It allows for customizable workflows – Adjusts estate planning procedures to align with firm needs, offering flexibility as the business evolves.

- It’s ideal for multi-user access – Supports collaboration by enabling multiple users to access and update estate planning data securely.

Investing in software that can grow with your firm is a strategic move that ensures scalability, adaptability, and long-term efficiency.

By choosing estate planning technology that evolves alongside your business, you can avoid costly replacements, improve your operations, and position yourself for sustained success in an ever-changing financial marketplace.

The Future of Financial Planning Starts With Holistiplan

In today’s evolving financial landscape, creating tailored estate plans is essential for providing clients with a truly comprehensive understanding of their financial health.

Holistiplan equips financial advisors and estate planners with cutting-edge tools designed to streamline this process, making tax and estate planning more efficient than ever.

Built by financial planners for financial planners, Holistiplan simplifies complex estate planning needs and gives clients the peace of mind they need when it comes to their financial futures.

By incorporating Holistiplan into your financial and estate planning firm, you can offer clients the ultimate peace of mind, ensuring their financial futures are protected and strategically planned.

With features like real-time updates, customizable estate plans, and advanced financial modeling, Holistiplan is an indispensable asset for tackling everything from straightforward tax strategies to intricate estate scenarios.

Our estate planning tools enhance accuracy, efficiency, and cost-effectiveness, enabling advisors to deliver a personalized, high-quality service while fostering trust and long-lasting client relationships throughout the entire estate planning process.

In an industry where precision and strategic foresight are paramount, Holistiplan stands out as a must-have solution for forward-thinking financial professionals.

If you’re ready to elevate your practice, enhance client confidence, and future-proof your estate planning strategy, then reach out to us today.

We can’t wait for you to discover what 40,000 other financial professionals have found to help make every client’s portfolio a financial success!

Built by CFP® Professionals,

for CFP® Professionals

Holistiplan was designed by experienced advisors Roger and Kevin to streamline your financial planning process. Achieve more for your clients in less time

Start Your Free 7-Day Trial