By Ben Birken, CFP®

Tax planning can make a huge difference in clients’ portfolios, but as an advisor, it can also be tough turning all that technical jargon into neat and easy-to-understand deliverables.

So how can you show the value tax planning brings to the table (without losing your clients’ attention in the process)?

Our Scenario Analysis tool was developed for exactly that purpose – it’s a simple, easy-to-use tool that creates possible tax projections in seconds. With the ability to not only estimate clients’ next tax bill, but also to demonstrate tax recommendations with real, concrete numbers, advisors can make a lasting and positive impression every tax season.

In this article, we’ve rounded up five special features of the Scenario Analysis tool that can help you highlight the value you provide to clients.

1. Tax Expense Estimation

Tax bills are one of the most expensive (if not the most expensive) bills of the entire year. To aid in cash flow planning, it’s helpful for clients to know exactly how much they’ll owe.

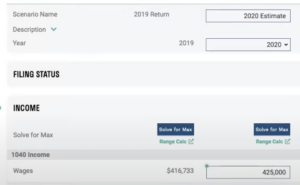

With just a few simple questions and the push of a button, you can deliver fairly accurate estimates of how much money your clients can expect to pay in taxes in the coming year.

2. Tax Expense Estimation – Special Event

Nobody’s financial situation is neat and tidy, so we’ve worked in a feature to our Scenario Analysis tool that accounts for just that.

Whether an individual is starting or closing a business, took an unexpected pay cut, or even won the lottery, you can work in these external events to create an accurate tax estimation.

In instances of forced realizations, like when a mutual fund makes a significant gains distribution, Scenario Analysis can uncover hidden advantages. Sometimes, it can actually be “cheaper” for clients to sell the mutual fund position if their realized gain will end up being lower than the actual distribution.

In cases of RSU vesting or stock option exercises where withholding doesn’t necessarily match actual tax obligations, you can help your clients set aside additional amounts for estimated taxes or year-end taxes.

3. Fine-Tuning Withdrawals

One question advisors hear from clients all the time: Where should I pull my money from?

This can be a difficult question to answer – each type of account has its own pros and cons as far as taxes go, so how can you consistently deliver the best advice?

Scenario Analysis to the rescue once again! With this tool, you can optimize where clients pull from their portfolios and what tax implications they can expect as a result.

For example, if your client is pulling money from a retirement account, you can determine exactly how much they should withhold on those withdrawals, thus demonstrating “tax efficiency” by creating cash flow from realized gains versus retirement account withdrawals.

4. Developing a Recommendation

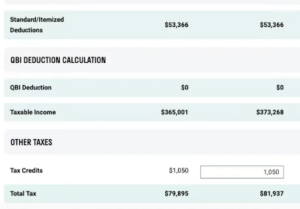

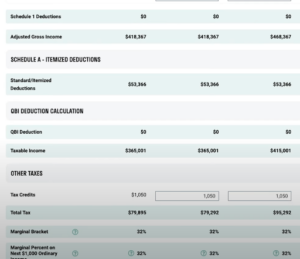

With Scenario Analysis, recommendations come with exact numbers. You can easily compare several different paths to move forward, while also showing the benefits and drawbacks of each. In short, it allows you to put real numbers behind their advice.

This can be especially useful when your clients are considering charitable contributions (such as donating appreciated stock or making QCDs), as well as when considering an increase in 401(k) or IRA contributions.

5. Demonstrating a Recommendation

After you develop your recommendations, the Scenario Analysis tool can show them in action, using side-by-side comparisons of baseline taxes versus what will happen if your specific recommendations (such as a Roth conversion) were implemented.

Connect with Holistiplan

Ready to see our Scenario Analysis tool for yourself? Click here to start your free trial of Holistiplan today.