Forecasting the Future: How the Right Financial Planning Software Can Be Your Best Tax Planning Tool

You’re an experienced financial advisor who has built an impressive array of financial planning tools to help your clients.

Yet one of the most powerful financial tools that advisors don’t add to their arsenal is comprehensive tax planning software.

Key Takeaways

- The best financial planning software for tax planning will be able to read a tax return and create a customized tax report and analysis in seconds.

- It allows financial planning experts to be more comprehensive and efficient in total portfolio management.

- Good wealth management software, coupled with tax planning software, can create a holistic financial plan for clients on all financial levels.

Index

- The One-Stop-Shop: Why Tax Planning Should Be Part of Financial Planning

- Knowledge is Power: What to Look for in Tax Planning Software

- Holistiplan: Completing the Financial Planning Circle

Tax laws are complex and can have a significant impact on a client’s finances.

That said, even the most experienced financial advisor struggles to find the time to educate themselves and their client on every new law or loophole introduced every tax season.

By learning more about tax planning software, you can begin to provide your valued clients with accurate, efficient, and comprehensive tax advice, ultimately improving their financial portfolio and saving you both time in the process.

Let’s find out how.

Built by CFP® Professionals, for CFP® Professionals

Holistiplan was designed by experienced advisors Roger and Kevin to streamline your financial planning process. Achieve more for your clients in less time

The One-Stop-Shop: Why Tax Planning Should Be Part of Financial Planning

In today’s complex and ever-changing tax landscape, tax accounting firms are no longer the only source for delivering comprehensive, strategic tax planning services to their clients.

While tax accountants are necessary for current-year tax filings, they may not always be the best resource for future tax planning.

Financial planners, on the other hand, may be the perfect solution.

Here’s why:

1. Advisors Have a Holistic Financial Strategy

Financial advisors have a comprehensive view of a client’s financial situation.

From investment strategies to estate planning, a financial advisor can’t adequately serve a client without looking at their entire financial picture.

By incorporating tax planning into the overall game plan, a good advisor can look at the entire picture and identify strategies that align with each client’s overall financial goals.

2. Advisors Have an Ongoing Relationship with Their Clients

Tax laws and regulations are constantly changing, and what works today may not be effective tomorrow.

Financial planners are well-equipped to deal with complex financial scenarios and continuously monitor and adjust their clients’ financial plans accordingly.

They also tend to meet with clients more than just once a year.

This ongoing attention ensures that clients are always taking advantage of the latest tax-saving opportunities and are prepared for any potential tax law changes.

3. Advisors are Educators

A good financial planner will have the heart of a teacher.

Their goal is to educate — not tell — their clients about various financial options and the potential impact of their decisions.

By incorporating tax planning into these services, financial planners can help clients understand the tax implications of their financial choices and empower them to make the best decisions for their situation.

Tax planning is no longer just about compliance — it’s about proactively identifying opportunities to minimize tax liabilities and maximize financial outcomes for clients.

Financial planners are uniquely positioned to integrate tax planning into a broader financial strategy, ensuring that clients’ financial goals are met in the most tax-efficient manner possible.

Knowledge is Power: What to Look for in Tax Planning Software

You are a financial planner, not a tax accountant.

You understand how to use retirement planning software and wealth management software.

But tax planning software?

It’s a bit outside of your comfort zone.

This is why you need to find tax planning software that is user-friendly and easy to understand.

Here are key factors to consider:

Comprehensive Features

Look for software that not only aids in tax preparation but also supports the development and implementation of tax strategies. It should help you stay organized by centralizing all tax-related activities and client information.

User-Friendly Interface

The software should be intuitive and easy to navigate, ensuring both your team and your clients can use it without extensive training.

Cost-Effectiveness

Evaluate different software packages to find one that offers the best value for your firm. Ensure the features align with your needs to avoid paying for unnecessary extras.

Robust Support and Resources

Choose software that provides ample instructional materials, educational resources, and troubleshooting support. This is particularly important for handling complex tax scenarios and ensuring smooth transitions.

Strong Security Measures

Given the sensitive nature of tax information, make sure you choose software that has robust security features, including strong encryption and secure data storage.

Client Communication Tools

The software should allow for easy and effective communication with your clients, allowing you to clearly demonstrate the benefits of various tax strategies and provide detailed reports on their financial situation.

Compatibility and Flexibility

Ensure the software integrates well with your existing systems and can be accessed across different devices. This flexibility is crucial for efficient workflow management.

By focusing on these factors, you can select tax planning software that will enhance the services you already provide and make tax planning both comprehensive and efficient for you and your clients.

Efficiency Meets Value in Financial Planning

Holistiplan bridges the gap between speed and quality, helping advisors like you deliver greater value to every client.

Holistiplan: Completing the Financial Planning Circle

Time is a precious commodity for all of us.

Implementing a new tool into your vast menu of client services needs to be seamless.

It also needs to save you time, not take up more of it.

Holistiplan tax planning software will do exactly that.

Holistiplan was founded in 2019 by two CFP® professionals who were looking for a way to deliver financial planning services more efficiently — and holistically — to their clients.

They knew there was a piece missing in their client’s overall portfolio of services. And they decided to do something about it.

Today, Holistiplan has over 30,000 members from the financial world, all with the same goal in mind…to be the one-stop-shop for a client’s total financial needs.

Here’s what Holistiplan will do for you:

Read a Client’s Return in Seconds

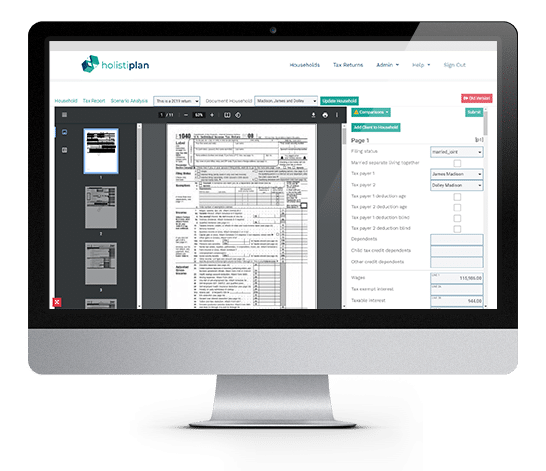

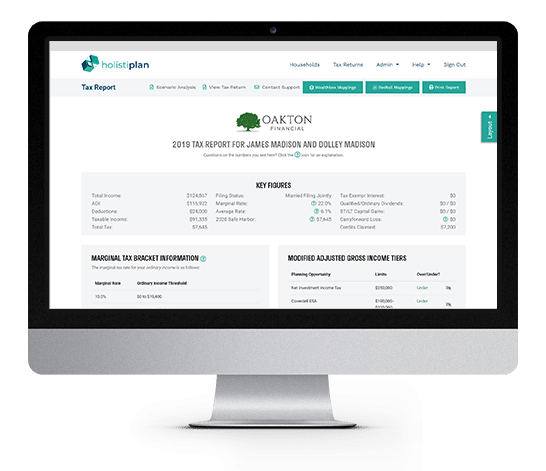

After you upload your client’s 1040 tax return, Holistiplan generates a personalized, branded tax report.

Generate Client Deliverables

This report is provided to you as a polished, easy-to-read tax summary for your client, featuring your firm’s logo and disclaimer. It can be saved as a PDF, emailed through a client portal, or printed for in-person review, providing an easy-to-interpret and inviting document for you and your client to work from.

Create Instant Scenario Analysis

OCR technology pre-fills a scenario analysis screen, enabling you to quickly pinpoint key income breakpoints for tax planning strategies. These can be things such as ROTH conversions, tax-efficient withdrawals, and charitable giving that you can then discuss in-depth with your client.

While tax accountants are necessary for current-year tax filings, they may not always be the best resource for future tax planning.

If you’re ready to learn more about bringing tax planning software to your firm, then reach out to us today.

Our goal is to make comprehensive financial planning more accessible to more families.

We look forward to you joining us on that journey.

Elevate Your Practice with Holistiplan

Holistiplan is trusted by thousands of advisors to deliver faster, more valuable financial plans. Start your free 7-day trial and see the difference for yourself