In the rapidly evolving world of financial services, estate planning is no longer just about drafting wills or managing wealth transfers—it’s about delivering secure, flexible, and client-centered solutions.

At the heart of this shift is a game-changing tool: cloud-based estate planning software.But software is constantly evolving, and knowing how to harness its full potential is what sets forward-thinking financial advisors apart.

- Cloud-based estate planning software makes daily processes faster and smarter.

- With encrypted client portals, real-time updates, and remote access, cloud software ensures that estate planning matters are handled securely, collaboratively, and without geographic constraints.

- Estate planning software integrates with your entire financial tech stack and scales alongside your practice.

- What Is Cloud-Based Estate Planning Software?

- Digital Efficiency: The Power of Cloud-Based Automation

- Security and Compliance: Why Cloud-Based Estate Planning Software Leads the Way

- Elevating Engagement: How Cloud-Based Software Increases Client Collaboration

- Scalable Growth: Cloud-Based Software for Your Firm’s Success

- Connection is Key: How Estate Planning Software Integrates with Other Financial Tools

- Remote Work and Flexibility is Easy with Cloud-Based Software

- Estate Planning Software Solutions Start at Holistiplan

From solo advisors who are just starting out to multi-office highly experienced wealth management firms, professionals across the board are embracing digital platforms that allow them to streamline workflows, improve client collaboration, and future-proof their practice.

Let’s look at why cloud-based estate planning software is worth the investment and what you should look for to make it a vital part of your financial software tech stack of solutions.

What Is Cloud-Based Estate Planning Software?

Cloud-based estate planning software is hosted online rather than installed locally on your devices.

That means all data, tools, and workflows are accessible through an internet connection—whether you’re in the office, at home, or meeting a client in their kitchen.These platforms typically offer:

Digital document storage:

While most estate documents will be created by an estate planning attorney who is using their own drafting software, estate planning software designed for financial advisors can keep it all organized.

Real-Time Updates and Compliance Tracking:

Stay ahead of changing laws and regulations with automated alerts and adjustments. Whether it’s tax planning reform or probate changes, your documents evolve with the times.

Secure, Encrypted Data Management:

Bank-grade encryption, two-factor authentication, and controlled access ensure sensitive client data is protected every step of the way.

Integration with CRM and Other Financial Planning Tools:

Connect seamlessly with your existing tech stack so information flows effortlessly across your practice.

Cloud-based estate planning software turns cluttered offices and complex coordination into streamlined, secure, and client-friendly experiences. That’s the power of digital transformation—and why it’s rapidly becoming the gold standard in client services and estate planning cases.

Digital Efficiency: The Power of Cloud-Based Automation

One of the strongest arguments for cloud-based solutions is operational efficiency.

Manual estate planning processes—like gathering client details, generating estate planning documents, and updating revisions—consume precious time and open the door to error.

The right cloud-based estate planning tools will automate much of this work, saving hours for you and your staff. Implementing adaptable software for estate planning also allows you to customize workflows that fit your practice’s unique demands.Key features often include:

- Smart form templates that adapt based on inputs

- Automated updates when tax laws or state regulations change

- Digital signature integration for remote approvals

- Task management tools to monitor team progress

For practices that handle dozens (or hundreds) of estate plans annually, this adds up to serious time savings—and less burnout.

Built by CFP® Professionals,

for CFP® Professionals

Holistiplan was designed by experienced advisors Roger and Kevin to streamline your financial planning process. Achieve more for your clients in less time

Start Your Free 7-Day TrialSecurity and Compliance: Why Cloud-Based Estate Planning Software Leads the Way

Security is non-negotiable when managing your client’s personal and financial data. Cloud-based platforms are built with bank-level encryption, multi-factor authentication, and audit trails to ensure every document and conversation is protected.

Beyond safeguarding client information, these tools can help any financial and estate planning practice to stay compliant in a number of ways:

For advisors, these factors help to minimize risk and ensure that your estate planning firm remains not only legally compliant but also trusted by clients for protecting their most sensitive information.

Elevating Engagement: How Cloud-Based Software Increases Client Collaboration

Today’s clients want more than once-a-year meetings and static paper folders. They expect on-demand access, transparent communication, and digital convenience.

Here are some ways that cloud-based estate planning makes this possible:Instant Document Sharing:

Clients can upload and review wills, trusts, and directives without waiting on email chains or scheduled appointments. Everything’s accessible in one secure place—anytime, anywhere.

Real-Time Collaboration:

Advisors and estate planning clients can leave comments, request edits, and track changes in real time, eliminating confusion and ensuring everyone’s aligned.

Centralized Portals:

A branded, user-friendly dashboard lets clients view timelines, pending actions, and key estate documents—all tailored to their planning journey.

Streamlined Intake & Updates:

Digital forms and questionnaires simplify data collection, allowing clients to submit info from home and receive faster, more accurate updates.

Automated Reminders & Notifications:

Clients get alerts for document reviews, beneficiary updates, or legal changes—keeping them engaged and proactive in their own planning.

By simplifying communication and making planning more collaborative, cloud-based software turns estate planning into a client-focused, interactive experience. It’s not just tech—it’s trust, built one login at a time.

Scalable Growth: Cloud-Based Software for Your Firm’s Success

Whether you’re a solo planner or part of a growing firm, cloud software is designed to scale.

As your client base expands, so do your practice management needs—more secure storage, more automated processes, more team coordination.

Comprehensive estate planning software is designed to grow with you.Benefits include:

- Team roles and permissions for streamlined collaboration

- Custom workflows to reflect firm-specific processes

- Access control for advisors, paralegals, and support staff

- Analytics dashboards to track performance and identify gaps

And because updates happen automatically, you won’t need to worry about constant upgrades or IT overhauls. You stay current, without missing a beat.

Elevate Your Practice with Holistiplan

Holistiplan is trusted by thousands of advisors to deliver faster, more valuable financial plans. Start your free 7-day trial and see the difference for yourself

Get Started TodayConnection is Key: How Estate Planning Software Integrates with Other Financial Tools

Estate planning isn’t an isolated function—it’s tied closely to retirement, investment, insurance, and tax strategies.

The best cloud platforms integrate seamlessly with other systems to create a holistic planning environment.You can connect estate planning software to:

CRM Platforms:

Sync your client database to track communication, meetings, and progress—giving estate planning lawyers an efficient way to manage relationships and workflows.

Financial Planning Software:

Integrate with retirement and investment planning systems to provide a unified view of a client’s financial life which is essential for accurate wealth transfer decisions.

Secure Document Management:

Estate planning legal software often connects with e-signature tools and encrypted storage services, allowing legal professionals to collaborate securely with clients and other advisors.

By leveraging these integrations, financial professionals can build truly comprehensive strategies, thus enhancing accuracy, simplifying communication, and strengthening long-term client relationships.

Remote Work and Flexibility is Easy with Cloud-Based Software

Since 2020, remote work has become a norm rather than an exception.

From elder law attorneys to financial professionals, cloud-based estate planning software has redefined how these experts collaborate, manage documents, and serve clients—without being tied to a physical office.

Whether you’re working from your office, a café, or traveling for a client visit, cloud access ensures:

This not only boosts productivity but also makes your practice more resilient in times of disruption.

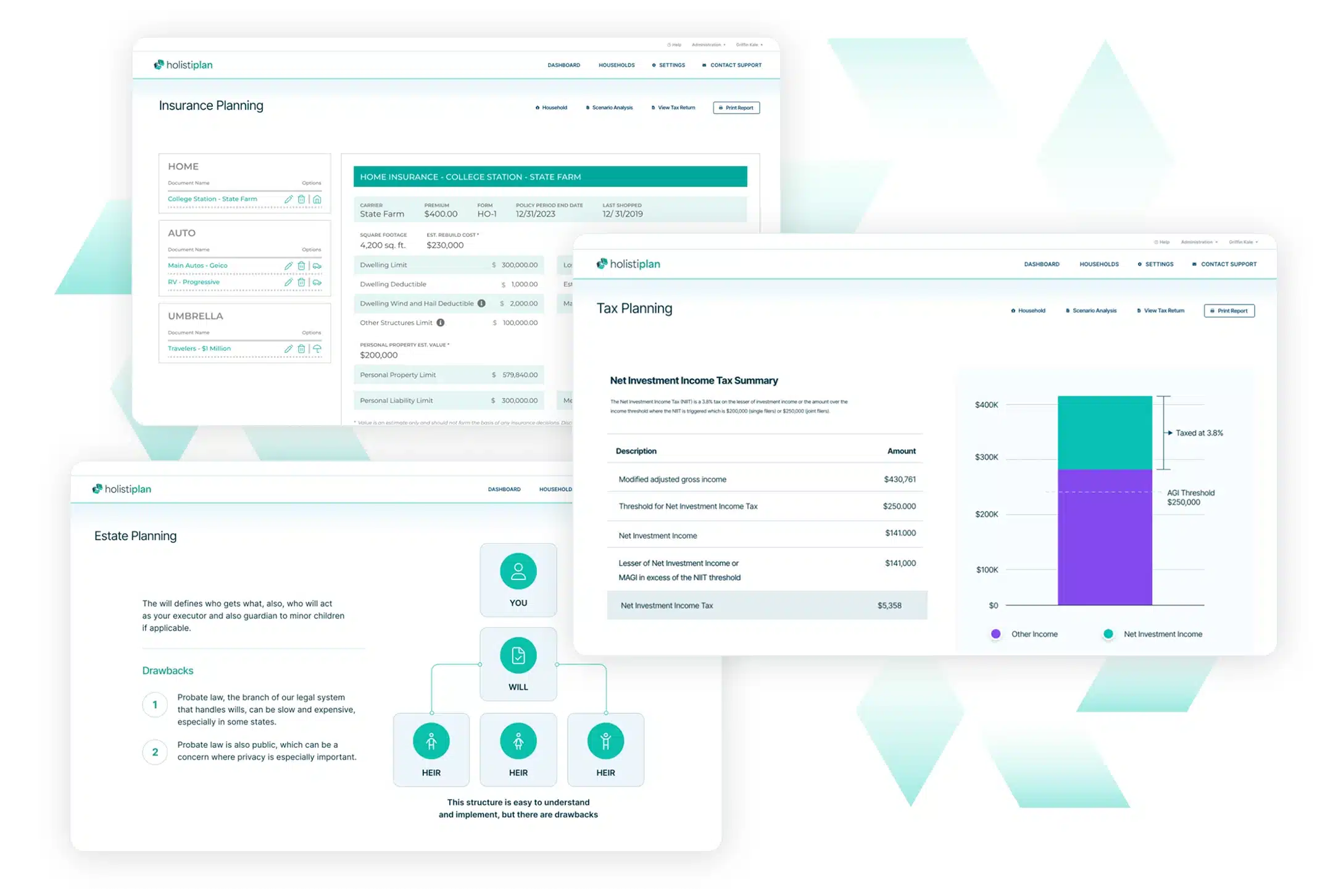

Estate Planning Software Solutions Start at Holistiplan

While estate documents like wills and trusts are usually drafted by estate planning attorneys, financial advisors play a vital role in keeping those plans organized, updated, and aligned with evolving life goals.

With the right estate planning software in hand, advisors can streamline coordination, monitor real-time changes, and ensure every piece of the plan fits together seamlessly.

Holistiplan simplifies complex planning strategies, allowing financial advisors to craft comprehensive, accurate solutions.

Whether you’re refining a long-term estate strategy or providing clarity during a life transition, Holistiplan gives you the confidence to help your clients build secure, well-structured futures.

Ready to strengthen your practice and show your clients why their estate planning truly matters?

Learn more about cloud based estate planning software and how it can transform your financial services.

Efficiency Meets Value in Financial Planning

Holistiplan bridges the gap between speed and quality, helping advisors like you deliver greater value to every client