Comprehensive tax planning for financial advisors

Want to see all that Holistiplan has to offer?

Holistiplan helps financial professionals at all levels do comprehensive tax planning quickly and easily for all their clients. Whether you’re a new advisor just beginning to offer tax planning to your clients or an expert tax planner, Holistiplan provides the tools you need to perform fast, scalable, uniform tax planning for all of your clients in a fraction of the time.

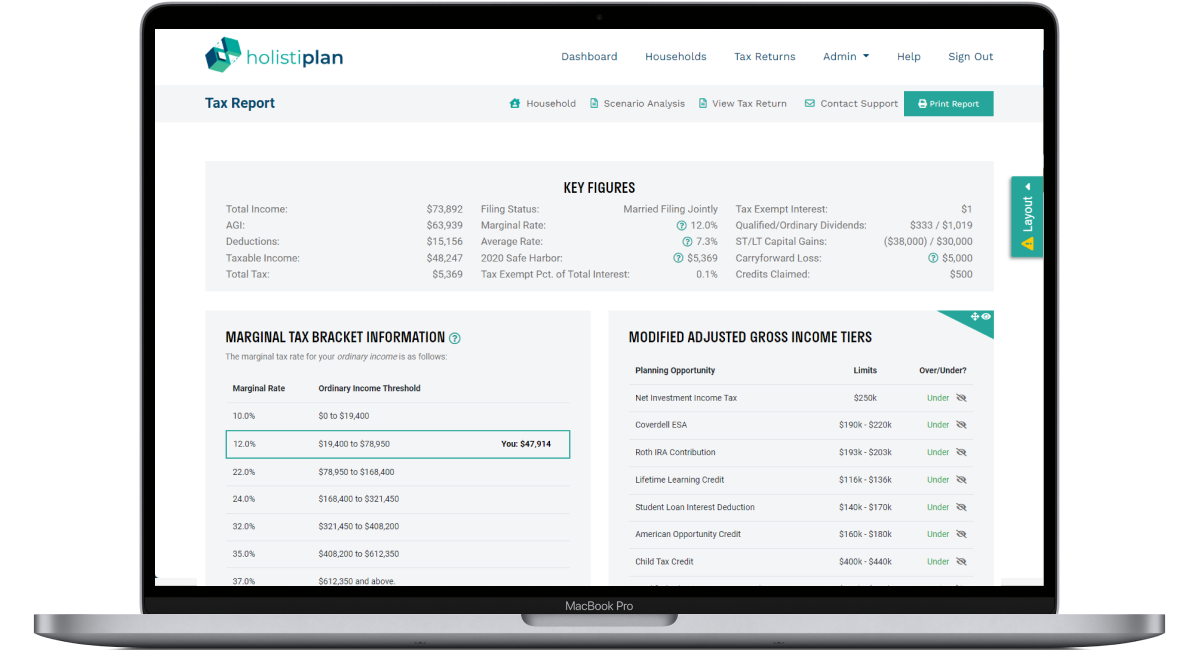

Tax Report

A clean and easy-to-read client deliverable customized with your firm’s logo and disclaimer. Review with your client in person or send to them as a PDF.

Standard subscriptions also include

Range Calculator

Identifies the tax impact of adding $1,000 increments to ordinary income or capital gains.

Scenario Analysis

Identifies key income break points for tax planning opportunities like Roth conversions, tax-efficient withdrawals, charitable giving, and much more.

Unlimited Users

Companies can have multiple users in a single account, eliminating the need for separate accounts.

Available Multi-Factor Authentication

Safekeeps your account from unauthorized access by requiring you to enter an additional code when you sign in with your password.

Integrations with Redtail, WealthBox, FP Pathfinder, and Kitces.com

Improve day-to-day processes and streamline your work flow with integrations that enhance the Holistiplan experience.

See all that Premium has to offer

A Premium subscription includes all of the basics as well as crucial features that allow you to compare scenarios, access explanative documents, and more.

Tax Explainer

Most clients don’t have a full understanding of their taxes; this report shows them the breakdowns in an easy-to-understand way.

Donor Advised Fund Explainer

This report offers the "why" and "how" information of DAFs and then goes on to demonstrate the estimated tax benefit.

Qualified Charitable Distribution Explainer

This report packages up the estimated tax benefit alongside other useful information on what a QCD is and how it works.

Tax Prep Letter

Make the process of sending letters at tax time uniform, branded, and consistent. Create positive touch points with clients, and great relationships with CPAs

CFP® Continuing Education Credits

12 free hours of CE credits for premium subscribers with no user limit. Watch live webinars once a month or from the catalog.

Standalone Scenario Analysis

Model planning scenarios without a tax return. This is great for clients or prospects who don’t want to send a tax return.

Weekly Age Reminder Digest

Opt-in email digest that sends advisors a list of the Age Reminders that get triggered for the week.